Crypto Contagion: How Does It Work, And Why Should You Care

When a large company goes bankrupt, many others follow its steps.

The term known as financial contagion initially emerged in the TradFi sector. Yet, crypto contagion works in a very similar way, with the FTX crash being the best example.

In fact, crypto contagion has become a hallmark of the new bearish cycle in 2022-2023. With so many centralized crypto firms failing, let’s investigate this phenomenon in detail so as to understand why this happens in the first place.

What is Crypto Contagion?

Crypto contagion refers to the potential for a significant decline in the value of one cryptocurrency to have a negative impact on the value of other cryptocurrencies.

This can happen when a large number of investors in one cryptocurrency sell off their holdings, causing a decline in value that in turn causes other investors in other cryptocurrencies to also sell off their holdings.

The result can be a widespread decline in the value of many cryptocurrencies.

The word “contagion” has been initially adopted by the economic sector from epidemiology. This subsection of medical science focuses on studying and analyzing how diseases spread across populations.

Financial contagion works in a way that is very similar to such diseases. It refers to the spread of an economic crisis within a specific region or market.

For the first time, this term was used in 1997 when the collapse of a Thai currency baht resulted in a large regional crisis. All countries from East Asia to Russia were affected then.

How Does Crypto Contagion Work?

Cryptocurrencies now represent an integral part of the global economy. Thus, the contagion of crypto markets works in the very same way as traditional financial markets.

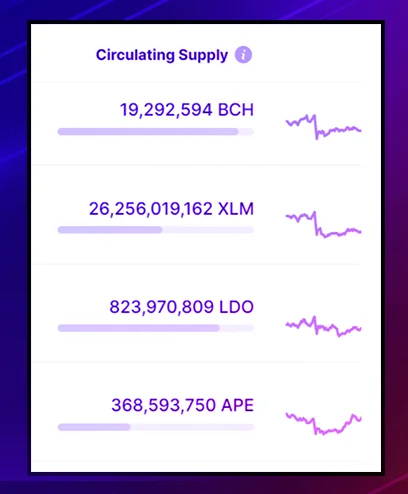

Large-cap cryptocurrency projects may experience a sharp decline in the value of their tokens. Usually, this happens when a big number of investors get panicky about some negative news and sell these tokens in a short period of time.

As a result, the token value drops initiating a major sell-off across other cryptocurrencies as well. Thus, such a domino effect spreads like a disease and may influence a large part of the market.

Many of the projects affected by this contagion lose money. Those with weaker economies simply go bankrupt.

The Reasons For Crypto Contagion

The key reason for crypto contagion lies in the integrated structure of the blockchain environment.

In the early years of the blockchain industry, various platforms operated independently from each other. The lack of interoperability was one of the fundamental problems that blockchain developers all across the world were striving to resolve.

But now, centralized exchanges and blockchain are more interconnected than ever.

The interconnectedness between centralized exchanges can contribute to crypto contagion in several ways:

- Price and Liquidity Spillover: Centralized exchanges play a significant role in the trading and price discovery of cryptocurrencies. When a negative event or significant price movement occurs on one exchange, it can quickly spread to other exchanges due to interconnected trading pairs and arbitrage opportunities. This spillover effect can lead to a contagion, where a decline in prices or liquidity on one exchange affects the overall market sentiment and trading activity.

- Dependency on Key Exchanges: Many cryptocurrencies rely heavily on a few centralized exchanges for liquidity and trading volume. If a major exchange encounters technical issues, security breaches, regulatory actions, or even goes offline, it can disrupt trading activities and create a panic among traders and investors. The loss of confidence in one exchange can spill over to other exchanges, leading to a broader contagion effect.

- Systemic Risk: The interconnectedness between centralized exchanges can create systemic risks within the cryptocurrency ecosystem. For example, if a large exchange experiences financial difficulties or becomes insolvent, it can trigger a chain reaction, impacting other exchanges, user funds, and the overall market. Such events can erode trust and confidence in the entire cryptocurrency market, leading to contagion and widespread selling.

- Market Manipulation: Interconnected exchanges can also facilitate market manipulation. If a trader or group of traders coordinate efforts to manipulate prices on one exchange, the impact can quickly propagate to other exchanges due to interconnectedness. Manipulative activities, such as wash trading or spoofing, can create false market signals, misleading other traders and triggering a contagion effect as they react to perceived market movements.

Examples Of Crypto Contagion

Okay, so the need-to-know concerning crypto contagion is clear. Now let’s review some examples of how this process works in practice.

Terra (UST) Collapse

Terra is an open-source blockchain protocol for dApps’ developers.

The crash of its algorithmic stablecoin UST in May 2022 was triggered by a successful hack of 80k ethers from Solana bridge Wormhole. The reason for such a serious blow was that Terra held a significant sum at stake on this platform.

UST’s collapse had a long-lasting impact on the whole crypto industry. Aside from dragging down a number of other algorithmic stablecoins like DEI and Neutrino USD (USDN), it negatively influenced large CEXes and crypto funds.

Since these institutions held a large portion of UST in their portfolios,they suffered heavy losses as the stablecoin’s price dropped down to zero. Thus, experts assume that it was the reason behind FTX’s collapse as well since UST led to trading losses for Alameda.

3 Arrows Capital (3AC)

Three Arrows Capital was a Singapore-based crypto hedge fund founded in 2012 by crypto enthusiasts Kyle Davies and Su Zhu.

The fund operated mostly with borrowed funds. It made profits on successful trading operations, including those with leverage on long positions.

The scheme worked fine for many years. Yet, Terra’s crash put an end to its successful business strategy.

3AC had large debts from Babel Finance, the company that went bankrupt right after Terra’s collapse. Its other key lenders BlockFi, Voyager Digital, and Celsius went bankrupt the same year adding troubles to the company.

FTX Collapse

Cryptocurrency exchange FTX used to be one of the top centralized exchanges beloved by many users worldwide. Yet, neither the support of the US government nor the large user base worldwide prevented it from crashing.

In November 2022, Coindesk published a report stating that a large portion of the exchange’s native token FTT belonged to its subsidiary, Alameda Research.

After the news came out, FTX faced a liquidity crisis as many users fled from an unreliable vendor. The leading crypto exchange Binance publicly promised to support FTX by purchasing a huge number of FTT but canceled its decision the next day.

In a few days more, the exchange reported an alleged hack that resulted in a loss of $477 million worth of crypto. Soon after that, FTX founder Sam Bankman-Fried resigned from his post, the FTX exchange suspended withdrawals, and the company filed for bankruptcy.

The consequences of the FTX fallout came forward soon. A DeFi platform BlockFi and a bunch of smaller startups that had exposure to FTX by investing in FTT went bankrupt, too.

Earlier Cases Of Crypto Contagion

The crypto market turmoil of 2022 has become grave to many crypto companies. Yet, it was not the first case of crypto contagion in history. Here are some other incidents of a smaller scope that happened before.

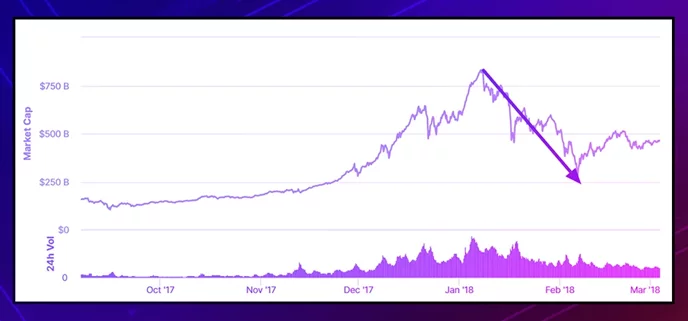

Bitcoin crisis in early 2018 caused a decline in the whole crypto industry. The overall market cap dropped by about 65% in a matter of a single month then.

An interesting fact is that the previous year was marked by the high popularity of ICOs. All those crypto startups flourished during the bullrun. Yet, they quickly went out of business when the leading cryptocurrency dropped in value.

Another crypto contagion of a smaller scale refers to the DogeCoin crash that took place in May 2021. This meme coin had been dwelling in oblivion since 2017 until Elon Musk pushed its price to unbelievable heights with a single tweet.

The joy of DOGE investors didn’t last long, though. Its price dropped almost as quickly as it spiked as the hype died down.

The effect of this decline wasn’t as large as what we saw in 2022. Yet, there were some other coins that suffered as well with DOGE’s key rival Shiba Inu being the best example.

Not A Reason To Despair

The crash of large crypto companies may become a disaster for many investors. After FTX’s crash, even the largest market player Binance experienced some troubles.

As every new spiral of the market’s path becomes larger, this contagion is most likely to spread into 2024 as well. This may be the worst crisis in crypto that we’ve seen in all years.

Yet, it’s not a reason for despair. Losing faith in the whole technology just because of some companies’ crashes is just stupid. Blockchain will remain regardless of all the blows that the industry experiences.

CasperLabs reports that already 90% of all businesses across the US, UK, and China start adopting blockchain to some extent. What’s more, 87% are likely to invest in a blockchain solution in the next 12 months.

Educating yourself is the best thing to do in such dark times. As centralized platforms fail, decentralized solutions get more support as they are devoid of such risks.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Kate

Kate is a blockchain specialist, enthusiast, and adopter, who loves writing about complex technologies and explaining them in simple words. Kate features regularly for Liquid Loans, plus Cointelegraph, Nomics, Cryptopay, ByBit and more.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant