Stablecoin Yields: Passive Income without Counterparty Risk

Stablecoins, when designed correctly, provide stability to an otherwise volatile cryptocurrency environment. They allow users to safely remain involved in crypto without losing money in bear market conditions. What if you could not only shield yourself from the downside of crypto, but also earn yield in the process? This is where stablecoin yields come into play.

Stablecoin yields give users crypto returns for holding various stablecoins and engaging in certain decentralized finance protocols. Yield farming your stablecoins can be profitable or catastrophic depending on which stablecoin you hold or which protocol you interact with.

What is a Stablecoin?

Stablecoins are tokens whose value is tightly correlated to another more price-stable asset through various peg mechanisms. The most common 4 types of stablecoins are fiat-backed, commodity-backed, crypto-backed, and algorithmic stablecoins. We will focus primarily on fiat-backed and algorithmic stablecoins for the purpose of this article.

Fiat-backed

Fiat-backed stablecoins are tokens whose value is backed, hopefully 1:1 or more, by fiat currency. The most prominent examples of fiat-backed stablecoins are USDC and USDT. These work because, in theory, if you have one USDC or one USDT, you can always take it to their vault and redeem it for one dollar. This redemption function is what holds people’s confidence in each token maintaining one dollar in value.

Algorithmic Stablecoins

Algorithmic stablecoins use smart contracts and algorithms to manage the token supply based upon market conditions at the time. Algorithmic stablecoins can be done correctly (USDL, LUSD) and they can be done incorrectly (UST). We will cover each in detail.

Stablecoin Yield Farming

Yield farming stablecoins is exactly how it sounds, it is the process of earning yield for holding or deploying stablecoins.

IMPORTANT. There are two key traps that people fall into when attempting to yield on stablecoins:

- Giving their keys to somebody else.

A user should NEVER give away custody of his tokens in order to earn yield. Doing this can result in a number of different outcomes from not receiving the promised returns all the way to losing principal. Centralized exchanges are notorious for losing funds and/or going bankrupt and not paying back their users.

#celsius. https://t.co/mLZsmWIz4A solves this. Not your keys, not your coins. Stop picking up pennies in front of freight trains! And the yield has been thousands of times higher! #CEL pic.twitter.com/jeGUELOxl4

— Richard Heart (@RichardHeartWin) September 18, 2021

2. Buying stablecoins with weak peg mechanisms.

The only force holding the price of a token to another asset is the redeemability of that asset. Meaning, is there a reliable transaction that will always exist in which you can swap one USDC for one USD? Or, is the stablecoin over or under collateralized? If a stablecoin is overcollateralized, then if all the stablecoins needed to redeem for $1 then they could so successfully. If a stablecoin is undercollateralized, then if all the stablecoins needed to be redeemed all at once, the protocol would fail.

So what is the solution then? How do we safely yield on stablecoins?

Best Stablecoin Yields

The best stablecoin yields come from utilizing your stablecoins in ‘true defi’ protocols. What is true defi? Typically, these are blockchain protocols with immutable, audited code with no counterparties and no admin keys. Examples of such protocols that provide stablecoin yield opportunities include UniSwap v3 Liquidity Providing, Liquid Loans Stability Providing, and Liquity Stability Providing.

UniSwap v3 Liquidity Providing

UniSwap v3 Liquidity Providing allows stablecoin holders to to place two different stablecoins into liquidity pools and earn trading fees for their services. On UniSwap v3, liquidity providing is a trustless, decentralized process in which you can earn stablecoin yields.

In addition, as long as you use stablecoins with strong peg mechanisms like LUSD, USDL, DAI, USDC, etc. then the risks of impermanent loss are small.

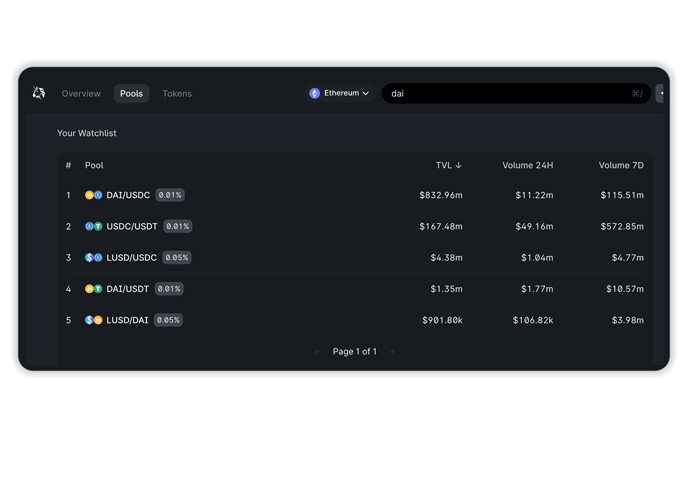

Below are various examples of stablecoin liquidity pairs on UniSwap v3, a decentralized exchange on the Ethereum blockchain.

Liquid Loans Stability Providing

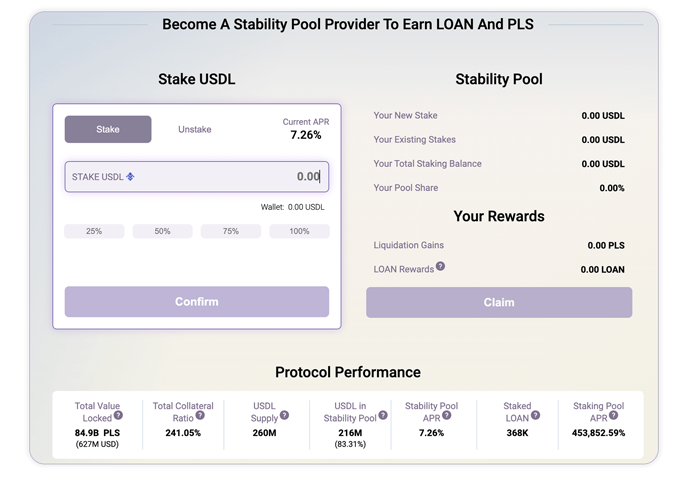

Liquid Loans is another example of a trustless way to earn stablecoin yields. Liquid Loans is a lending protocol on PulseChain. Within the protocol, users can mint USDL stablecoin from locking up PLS tokens in a vault

In order to make sure that the PLS tokens are always overcollateralized, USDL holders are encouraged to place their tokens in the USDL Stability Pool. The USDL stability pool is used to pay back undercollateralized vaults at a premium. As a result, users who place their USDL in the stability pool earn variable yields.

The Stability Pool is a great place to store dry powder on PulseChain while earning returns. The Liquid Loans protocol is not live yet, but you can play around on the Testnet as seen below.

Liquity Stability Providing

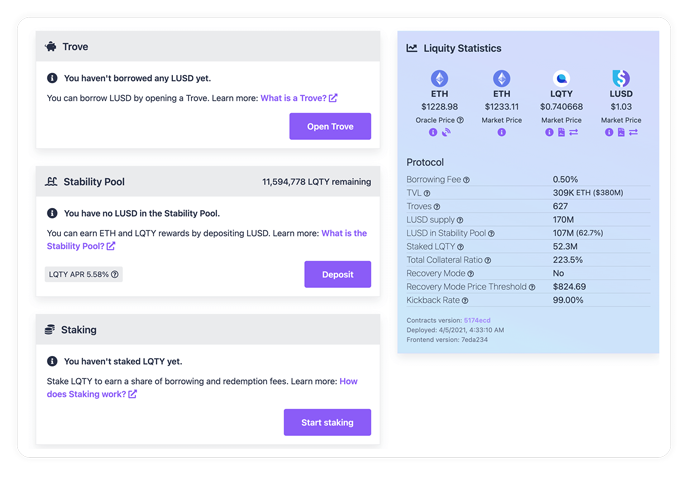

The Liquity Protocol is a near clone of the Liquid Loans protocol which currently exists on the Ethereum blockchain. Liquity operates in a similar fashion as Liquid Loans except it uses ETH as collateral and mints LUSD as the stablecoin. Users can deposit LUSD in the stability pool and earn yield for buying back undercollateralized vaults at a premium.

Worst Stablecoin Yield Plays

Despite there being many reliable options for earning stablecoin yields, crypto users regularly make bad decisions when chasing returns. As stated previously, bad decisions typically result from giving custody of your coins to another entity or holding stablecoins with weak peg mechanisms.

Terra USD (UST)

The most glaring example of a bad stablecoin yield play was TerraUSD. UST was a poorly designed algorithmic stablecoin with as little as 10% of the stablecoin backed by any collateral. Anchor protocol was offering 20% yield on the stablecoin at the time. Suddenly, Anchor announced a severe cutback on the yield offered and reduced the demand for the stablecoin dramatically. When, users went to redeem their UST for the underlying collateral (LUNA) there was not enough value and the protocol collapsed.

#UST the "$1" stable coin isn't looking so stable. $UST pic.twitter.com/CR7vJLNy0c

— Richard Heart (@RichardHeartWin) May 10, 2022

Celsius

Another glaring and recent example of a bad stablecoin yield play was Celsius. Celsius was essentially a “bank” where users could deposit various cryptocurrencies, including stablecoins, and earn yield on them. The problem was that yields could not be promised, and users gave up custody of their own tokens. As a result, when Celsius went bankrupt due to unfavorable market conditions, they could not pay back the deposits of their users, and many people lost everything.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Connor

Connor is a US-based digital marketer and writer. He has a diverse military and academic background, but developed a passion over the years for blockchain and DeFi because of their potential to provide censorship resistance and financial freedom. Connor is dedicated to educating and inspiring others in the space, and is an active member and investor in the Ethereum, Hex, and PulseChain communities.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant