Dai of Maker Dao: Exposing the Risks of the "Decentralized" Stablecoin

DAI is advertised as a decentralized stablecoin.

But due to its fundamental design and recent changes, it is actually highly centralized.

"DAI was a staple for many years in the Defi community, but with its constant moves toward tradfi and off chain assets, it has huge red flags. Look at its attachment to the USDC peg. Much larger risk profile than many would admit."

- WaLLrus

This blog post will cover the 6 reasons why Dai is NOT decentralized and actually very risky.

Dai and the Maker Protocol can be super complicated, so I’ve simplified it and only included the important parts.

What is Dai?

Dai is a crypto-backed stablecoin which is soft-pegged to the US dollar.

It is generated by users who deposit collateral into Maker Vaults and mint stablecoins off of it.

Dai has a minimum collateral ratio of 150%, meaning users need $1500 of collateral if they wish to mint $1000 of Dai.

Once minted, users are free to send, receive, swap or even earn interest on their new coins.

What is the Maker DAO?

MakerDAO is a decentralized autonomous organization (DAO) that operates on the Ethereum blockchain.

It is responsible for creating and maintaining the Dai stablecoin, which is designed to maintain a stable value relative to a fiat currency, usually the US dollar.

Maker DAO, as the name suggests, holds votes to change aspects of the protocol.

The primary stakeholders of the Maker Protocol are MKR token holders who have the ability to vote on proposed changes to the system using the on-chain governance system. This system consists of two types of votes: Governance Polls and Executive Votes, and any individual who owns MKR can participate in these votes.

MKR token holders exercise their voting power to decide on a range of matters including system parameter changes, mandates, bug fixes, technical improvements to the protocol, governance-related processes, and operational spending for the system.

This means that whoever holds the voting majority of the tokens, can decide the debt ceiling of the vaults, the stability fees, and can change other aspects of the code with their admin key.

Now that we have a baseline understanding of Dai and Maker DAO, let’s get into the problems with them.

The 6 Risks of Dai

Centralized Collateral

Dai, by definition, cannot be decentralized if it is collateralized by a centralized asset.

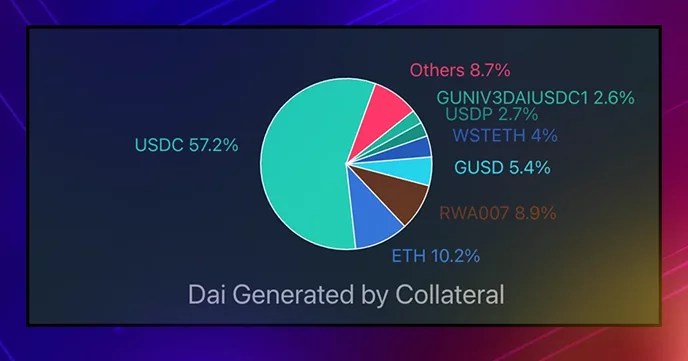

USDC makes up 57.2% of the assets backing DAI.

Pulled From Dai Stats

USDC is a highly centralized, fiat-backed stablecoin issued by Circle.

Circle has frozen the USDC in some wallets in the past i.e. they censored people’s money who behaved in ways they did not like.

Regardless of the circumstances, a stablecoin that can do this is NOT decentralized and it is the opposite of why crypto was invented.

Fractionally Reserved Collateral

Since USDC is the primary collateral used to generate DAI, we have to look at USDC with a microscope.

Circle holds the majority of its reserves for USDC at the mammoth shadow-bank, BlackRock.

But, they also held over 8% of their reserves, or over $3 billion USD, at the failed Silicon Valley Bank.

In response to this news, USDC temporarily depegged from $1 and dipped to as low as 87 cents.

Pulled From DexScreener

Although these funds will likely be recovered and USDC has since returned to $1, at one point USDC was fractionally reserved.

Although these funds will likely be recovered, at one point USDC was fractionally reserved.

Potential Centralization DAO Ownership

DAOs are not necessarily as decentralized as the name suggests. It’s very possible that a large player, or a large group of players can take majority control over a DAO and skew the votes in their favor.

This would give them the ability to change the rules of the system such as the collateral level, the fees, the tokens approved to be used as collateral, and much more.

DAOs offer the ability for large players to gain at the expense of the smaller players.

Lengthy Liquidation/Auction Process

Dai has a multi-hour long liquidation process. Due to it being lengthy, rather than instant like Liquid Loans, the vaults require a higher collateral level.

This overall makes the system state less capital efficient and causes borrowers to lose more in the event of a liquidation.

NOT Directly Redeemable

Dai is not directly redeemable for $1 worth of crypto-collateral by anybody.

This means there is no incentive for crypto arbitrageurs to buy up discounted Dai, to push the price up, and redeem it for collateral at a premium.

Contrast this with the Liquid Loans protocol.

Any holder up USDL can redeem 1 USDL for $1 worth of PLS from the lowest collateralized vault in the system.

This ensures that any time the price of USDL dips below a dollar, which is inevitable, holders get their value back in PLS.

This creates a hard peg to 1 USD.

Centralized Oracle Service

Maker DAO relies on Chainlink for price feeds to set the collateral ratios of its vaults.

Chainlink relies on a multisig to input price feeds and has admin keys which makes it highly centralized by nature.

Any protocol which relies on an oracle like this is taking on the risk of receiving an incorrect price feed which could destroy the system state.

A better option would be a truly decentralized blockchain oracle such as Tellor or Fetch.

The Bottom Line

DeFi needs secure and truly decentralized lending and stablecoin protocols.

We need lending for capital efficiency as well as the ability to extract value without selling which has tax implications and pushes the price down.

We need stablecoins for price stability and the ability to transact.

Dai of Maker DAO, although revolutionary for its time, has several components which make it centralized and risky.

Liquid Loans, and USDL, on the other hand is True-Defi, meaning it has no governance, no admin keys, a hard-peg to $1, and is completely immutable.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Connor

Connor is a US-based digital marketer and writer. He has a diverse military and academic background, but developed a passion over the years for blockchain and DeFi because of their potential to provide censorship resistance and financial freedom. Connor is dedicated to educating and inspiring others in the space, and is an active member and investor in the Ethereum, Hex, and PulseChain communities.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant