What is Matcha XYZ? (Limit Orders, Fees, Token, Airdrop and More)

Everybody wants to get the best deal when making a trade.

But the world of DeFi presents many different decentralized applications with varying liquidity pools.

Matcha XYZ is a one stop shop to help you find the best deal across multiple platforms.

Quick Takes:

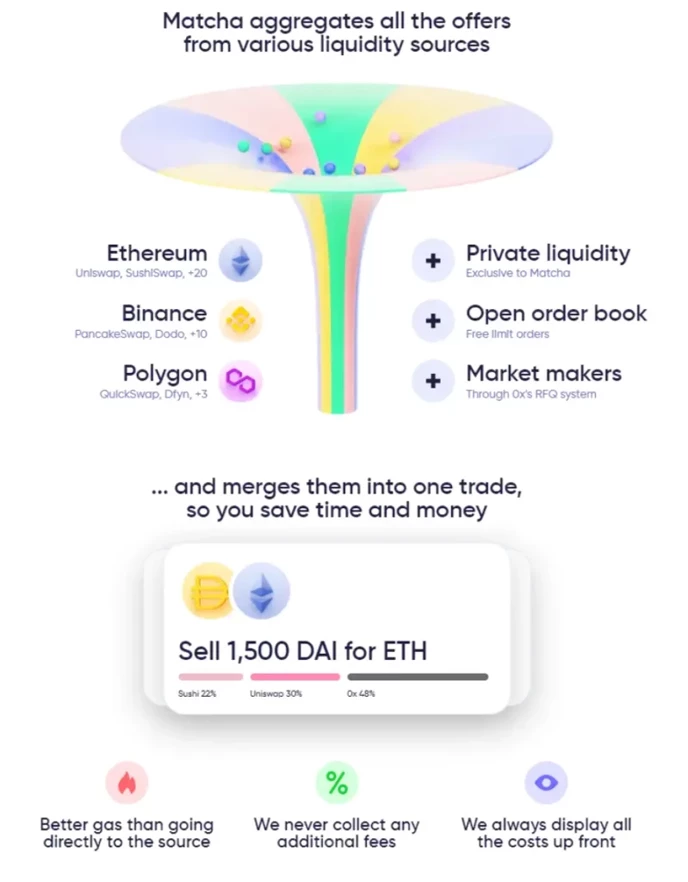

- Matcha XYZ is an DEX aggregator that uses the 0x protocol to make transactions more efficient than directly trading on DEXs.

- Since the 2.0 update, Matcha supports limit orders, OTC trading, and thousands of tokens across the eight most common blockchains.

- As it gains more users and daily volume, a Matcha XYZ token and airdrop might be announced soon.

What is Matcha XYZ?

Match XYZ is a DEX aggregator launched by 0x Labs on June 30 of 2020. It’s a minimalistic platform that finds the best prices and liquidity across +50 DEXs. It also leverages the “0x API,” resulting in better rates on Matcha than direct sources about 72% of the time.

Matcha XYZ underwent a 2.0 update on June 3rd of 2021 that expanded its features (more tokens, networks, fiat on-ramps) and improved its relevance. As of January 2023, Matcha XYZ stands for 5%-10% of the total aggregator volume and ~400 daily users on average.

For context, the 0x Protocol is a set of smart contracts that facilitate trading ERC-20 tokens. It was launched in 2017 by 0x Labs, founded by Will Warren and Amir Bandeali. It facilitates the creation of DEXs on Ethereum, such as Radar Relay, Paradex, Tokenlon, Bamboo Relay, and Lake Project.

Matcha is the newest and only one created by the same dev team.

As a DEX aggregator, the tool searches across different DEXs to find the best price/liquidity for a specific trade. Then, it uses the 0x API to optimize trade execution and slippage. That is the token price difference since you make the order until it’s filled.

Matcha XYZ Token

As for 2023, there’s no Matcha XYZ token, and there haven’t been any announcements yet. The closest native “token” is 0x (ZRX). It’s used for staking and on-chain governance for the 0x DAO (founded in 2019), which might influence Matcha XYZ.

But besides token swaps, it’s not related to Matcha’s features. The aggregator also has an informal governance community to suggest new features.

With that said, the launch of a Matcha XYZ token is quite likely. Because it’s the third DEX aggregator by trading volume, and except for 0x API, both more and less popular competitors already have tokens.

What’s the Matcha XYZ Airdrop?

Dapp developers sometimes ‘airdrop’ new tokens to encourage their trading and attract new users. If you look up DEX aggregators on Airdrops.io, you will find 1inch, Paraswap, and CoWSwap. Could there be a Matcha XYZ airdrop next?

No way to know until a token announcement. But if there is, it’s going to reward the most active users. To qualify, make sure to connect your wallet to Matcha and trade any tokens on Ethereum. Trading larger amounts and on other networks should increase your chances of winning those free tokens.

Matcha XYZ Fees

In March 2023, Matcha XYZ fees are as follows:

Matcha XYZ fees favor traders who add liquidity via limit orders (explained later). Taker fees refer to instant market orders, the lowest ones being for wrapped Bitcoin, Ethereum, and common stablecoin pairs. Both taker and maker orders can be free when the best quote comes from the Professional Market Makers (0x Protocol).

You can find the fee breakdown on the same window before reviewing the swap:

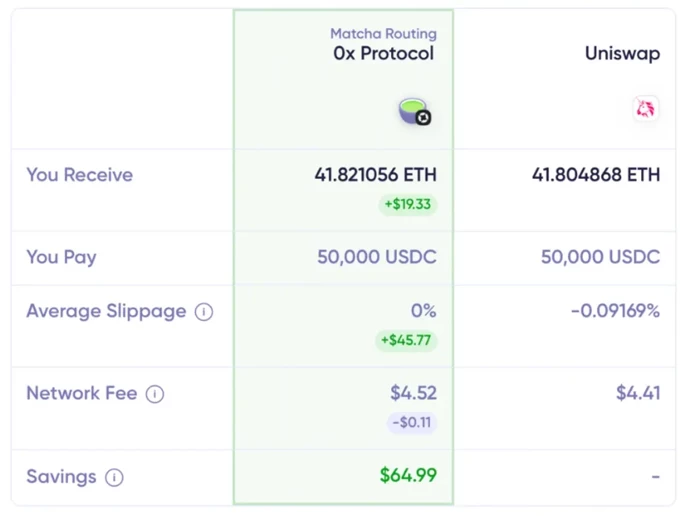

Even though fees are built into prices, the platform doesn’t show exactly how much is revenue. The original fee structure was 0.3% in taker orders, 0.2% going for liquidity providers and 0.1% for Matcha. Regardless, the best quote found on Matcha, whether it’s from 0x Protocol or Uniswap, is probably the lowest.

Some DEXs will still have better rates than 0x’ gasless trades. So if your order preview doesn’t show free gas, it’s still a good deal.

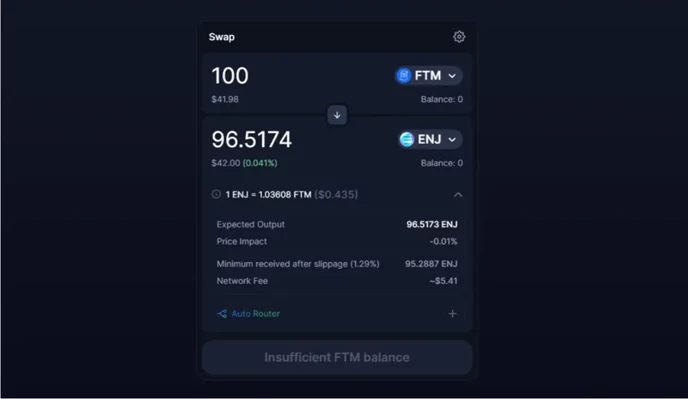

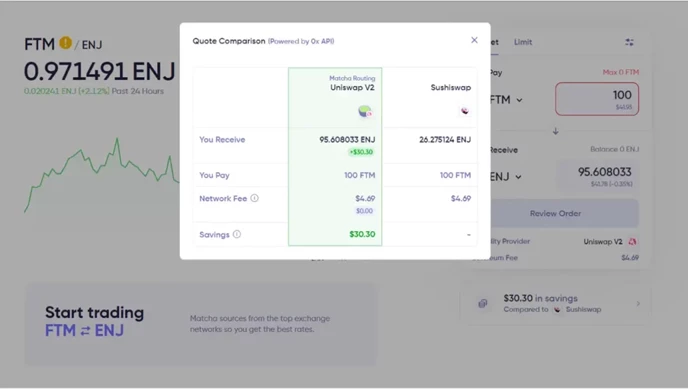

For comparison, here’s a sample trade of 100 Fantom for Enjin on Matcha and Uniswap v3:

The Uniswap (v3) quote offers more tokens but higher slippage. Reducing the slippage might beat Matcha’s offer but fail the transaction. Matcha’s smart ordering routing found Uniswap v2. It’s slightly less with lower fees.

The question is: why is it comparing Sushiswap? Is it choosing the second best or whatever DEX makes their savings look bigger? It’s advisable to manually compare with your favorite DEXs anyway.

How to Set a Matcha XYZ Limit Order

Matcha XYZ Limit orders are fee-free. Two costs are slippage (lowest possible) and network fees when 0x Protocol isn’t the liquidity provider. Another smaller gas fee applies only when manually canceling orders.

As for 2023, only the Ethereum network supports limit orders. Matcha wants to soon support more blockchains, starting with Polygon and Binance Smart Chain (BSC, now BnB).

With that said:

- To create a limit order, go to Trade in the top right corner.

- Next to the token chart, switch networks to Ethereum

- Switch your crypto wallet to Ethereum and connect

- Select the tokens you want to swap (You Pay/You Receive). If your token symbol doesn’t appear, pasting the ERC20 contract should show it. You can find that on Coinmarketcap and Etherscan.

- Choose from five expiration options from ten minutes to seven days.

- After Review Limit Order, you can preview the conversion. As a maker order, there are no quotes and fees are minimal. But filling your order may take longer than reaching your target price.

- From here, you Confirm, sign the contract on Metamask, and wait a few seconds to create the order.

How to Set a Matcha XYZ Market Order

Market orders include more settings and quotes, and completing one is as easy as on exchanges directly. Matcha is designed to exclusively swap tokens, unlike other aggregators that include liquidity pools, farms, NFTs…

From the home screen, go to “Start Trading” or “Trade” and select the two tokens to exchange. The top right corner shows Advanced Settings.

From the home screen, go to “Start Trading” or “Trade” and select the two tokens to exchange. The top right corner shows Advanced Settings:

- Slippage from 0.1% to 20% (0.5% default)

- About 51 exchanges to filter

- Custom gas price settings

Once set, the best quote will appear below with a comparison option.

There’s minimal slippage for deep-liquidity tokens like stablecoins, especially with the Over-The-Counter (OTC) feature. To use it, make an order between $1K-$1M for any of these pairs: WETH-USDC, WETH-DAI, WETH-USDT, or WETH-WBTC.

Review the order before it expires and complete it on Metamask.

How Does Matcha XYZ Work?

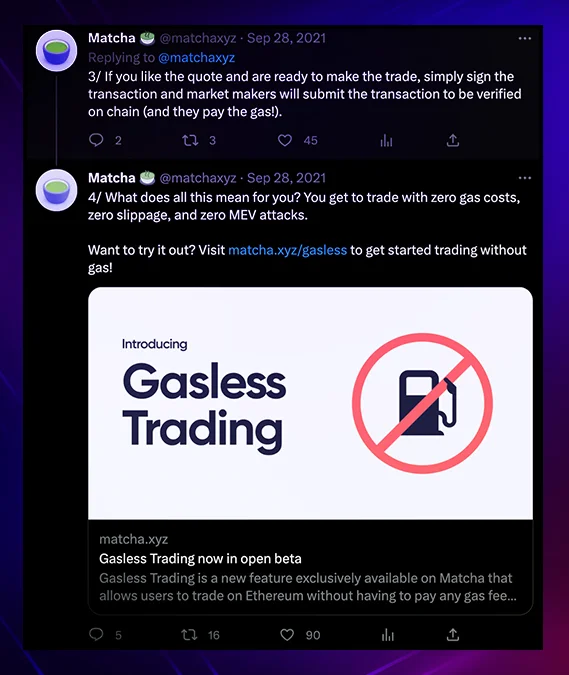

So how does Matcha supposedly offer better trading than other aggregators? And how are gasless trades possible? The answer is in the 0x API.

Gasless doesn’t really mean gas-free, but rather gas fees paid by someone else. Professional Market Makers are DEX components that the Matcha team has pre-approved because of their deep liquidity and wide asset range. (Automate) Market Makers are programs that provide liquidity to DEXs and use math formulas to balance prices in token “liquidity pools” funded by users.

Note that Matcha XYZ doesn’t disclose how many or who they are.

Why are they paying for your fees? It just happens to be convenient for these AMMs. With Matcha gasless trading, some DEX is receiving liquidity to rebalance pool prices. And for Matcha taker* orders, most built-in fees go to those providers.

Another reason “gasless trading” is possible is because of optimization. 0x API launched in February 2020, and the only aggregators that launched after this date are Matcha and CowSwap. Except the former is from the same 0x team.

Another misconception is, the best quote doesn’t come from a single DEX. That dApp might have the best rates, but Matcha XYZ still sources from multiple DEXs (connected to the 0x network)— also called smart order routing.

More DEXs normally means more fees, but the 0x protocol uses off-chain orders to reduce the number of on-chain transactions, reducing costs, time, and slippage.

Can Matcha XYZ Replace DEXs?

Matcha XYZ seems promising, and it does save users time and costs most of the time. If it’s so efficient and useful, why isn’t it used more often? It might outcompete DEXs, but other aggregators?

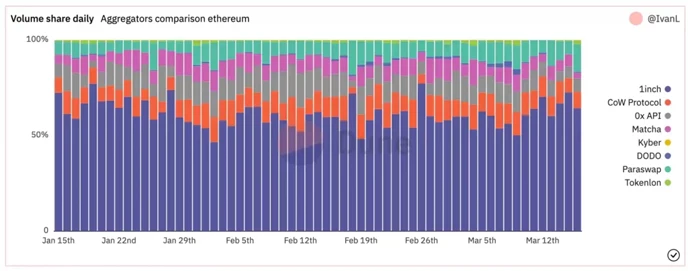

Almost two years after launching, Matcha has built an active community, but it’s nowhere close to 1inch’s numbers. It’s not necessarily better but is the very first aggregator launched ~10 months before Matcha. CowSwap seems to have the same issue and launched in mid-2021.

1inch can provide the best expected* rates, but there’s more slippage than on Matcha. It also provides a few more networks and alternative DeFi tools. Matcha may not be as versatile, but its optimization makes it a great alternative to Ethereum DEXs like Uniswap.

As Ethereum becomes more scalable, however, cost-efficiency won’t be as relevant. One way Matcha XYZ could increase its value is, for example, to enable swaps of tokens from different blockchains. That’s if we first overcome the not-so-obvious risks of DeFi bridges.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Max

Max is a European based crypto specialist, marketer, and all-around writer. He brings an original and practical approach for timeless blockchain knowledge such as: in-depth guides on crypto 101, blockchain analysis, dApp reviews, and DeFi risk management. Max also wrote for news outlets, saas entrepreneurs, crypto exchanges, fintech B2B agencies, Metaverse game studios, trading coaches, and Web3 leaders like Enjin.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant