Ultimate Guide To LP Tokens [Liquidity Providing Explained 2024]

If you’re in crypto for the long run, there are better ways to invest than just holding. Sure, you could lock your coins for months to get rewards, but what if you want to have both available? That’s what LP tokens are for.

Maybe you’ve heard before about DeFi lending and staking. But there’s a less-known option in this yield farming trinity. It’s called liquidity mining.

Not only can you get your coins out anytime. But you also get diverse rewards such as fee revenue, staking interest, and “LP tokens.” Not without its risks, though.

This guide will walk through everything there is to know about LP tokens and how to use them.

Quick Takes:

- LP Tokens are tradeable units that you receive after providing other tokens to a DEX liquidity pool. You can use them as a receipt to withdraw your pool assets anytime, but also lock them on other DeFi dApps for extra rewards.

- The total number of LP tokens is arbitrary and changes whenever someone adds or withdraws token pairs from the pool. Under unchanged conditions and a sideways market, LP tokens are worth what you deposited.

- You can reduce risk exposure by providing stablecoins, setting price ranges, or staking LP tokens.

What Are Crypto Liquidity Providers?

In the context of decentralized finance (DeFi), liquidity providers often provide liquidity to decentralized exchanges (DEXs) or automated market makers (AMMs). They do this by depositing a pair of tokens into a liquidity pool, which allows traders to exchange between those tokens without needing a centralized exchange or counterparty.

In exchange for providing liquidity, liquidity providers earn a share of the trading fees generated by the exchange. This incentivizes them to maintain balanced liquidity in the pool, so that trading fees continue to flow in.

Crypto trading is one of the most liquidity-dependent services. Liquid assets are those that you can instantly trade either way at a fair price. If you need to wait for a buyer, there are too many sellers, or your order is so big that it impacts the price, that is low liquidity.

If you think about it, liquidity and market prices are correlated. If you buy Bitcoin at $30,000 and it drops, it means there aren’t buyers willing to buy your Bitcoin at that price anymore. How far and quickly it drops depends on how many buyers— liquidity providers— are below your price.

Volatility happens when liquidity is low.

We use it for granted because we’re used to having a company manage all the funds. One difference between centralized and decentralized exchanges (CEXs vs DEXs) is that users can transfer ownership of their coins or keep it. There are no asset managers in decentralized finance.

Instead, there are liquidity providers— regular crypto traders— lending their coins to exchanges for a share of their revenue. Because of these providers, users can trade more tokens than on traditional exchanges and within minutes, even if there aren’t buyers at your price. And without trusting the platform.

Not only do providers make fee revenue, but they can anytime withdraw their “loan” using LP tokens.

What Are LP Tokens?

LP tokens, or liquidity provider tokens, are tokens that are issued to liquidity providers on decentralized exchanges (DEXs) or automated market makers (AMMs) in exchange for contributing liquidity to a liquidity pool.

When a liquidity provider deposits a pair of tokens into a liquidity pool, they receive LP tokens in proportion to their contribution to the pool. These LP tokens represent the liquidity provider's share of the pool and can be used to withdraw their share of the liquidity in the pool at any time.

LP tokens are also used to track a liquidity provider's share of the fees generated by the exchange. For example, on an AMM like Uniswap, every trade incurs a 0.3% fee, which is then distributed to liquidity providers based on their share of the pool. LP tokens enable liquidity providers to claim their share of these fees.

LP tokens can be traded on DEXs like any other token, but they are not the same as the underlying assets in the liquidity pool. Instead, they represent the liquidity provider's stake in the pool and can be redeemed for a portion of the underlying assets.

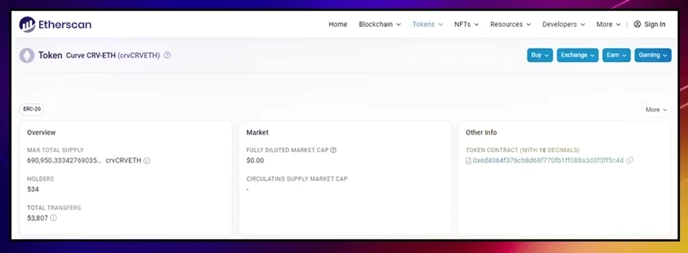

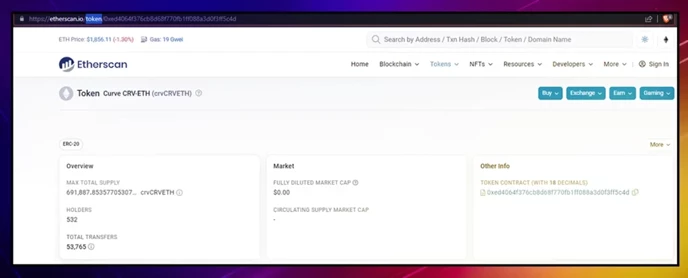

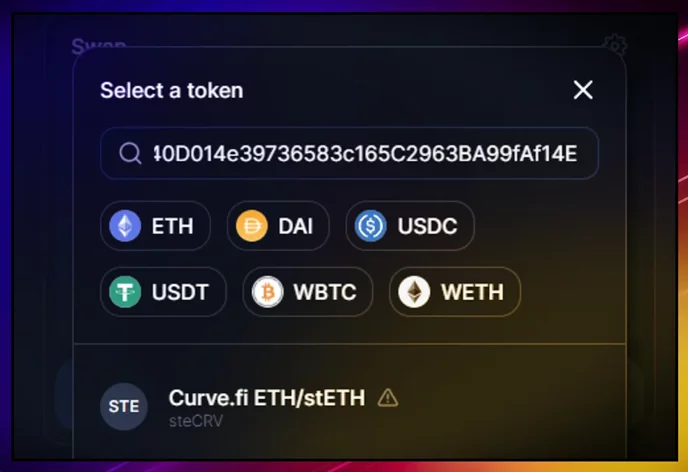

Liquidity Pool (LP) tokens are specific to liquidity pools, their tokens pairs, and the DEX platform. For example, this is the CRV-ETH LP token from Curve.fi:

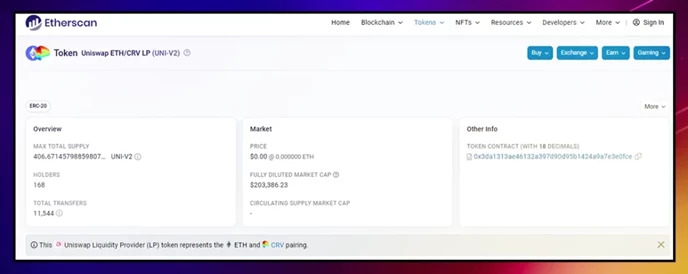

And here’s a completely different pool with the same token pairs on Uniswap v2:

You might see one big difference. The first pool has almost 700,000 LP tokens and the Uniswap one has 400. Since they’re both exchanging CRV and ETH, both probably have the same rates. The max supply is different because it’s arbitrary and changes with the pool valuation.

LP tokens represent the provider’s share of the pool and, ironically, also provide liquidity to themselves. So while their CRV and ETH tokens are deposited, they receive “free” LP tokens to spend as if they were the same. Whenever you want to withdraw your original tokens, you have to return those LP tokens.

Let’s use the previous two as an example. Suppose both Curve and Uniswap pools are worth $180M, and you provide $20M (worth of CRV and ETH) to each. On both pools, that’s 10% of a $200M total, which means you get 10% of all LP tokens.

On Curve, you would get 70,000 “crvCRVETH,” and on Uniswap, 40 “ETH/CRV LP.” Both are worth the same $20M, but they’re not interchangeable because they represent pool shares. By selling these tokens, you’re transferring ownership of $20M worth of CRV and ETH.

Instead, you can lock both LP tokens on their respective platforms to get interest rewards.

So you’re getting 10% of the pool’s fee revenue, and your LP tokens also earn rewards somewhere else.

How LP Tokens Work

In short, LP tokens allow us to redeem pool assets, send asset “ownership” to someone else, or stake for interest rewards. All without needing other users’ permission. So exactly is it possible without risking someone else’s coins or the platform’s value?

LP tokens are one of many components that make liquidity possible. The first thing to know about liquidity providing is that your tokens go to another wallet. It’s not a user-controlled one, but a collective wallet that only smart contracts can use.

Smart contracts, simply put, are automated programs that use blockchain data (e.g. Ethereum platforms). Like a vending machine, you deposit tokens, and the pool contracts release LP tokens to your wallet. Except that this machine also works in reverse: deposit LP tokens to release original assets.

However, programs don’t store or send LP tokens. Users do. Instead, they create or destroy them to ensure that all users have the right proportion. E.g. If everyone leaves the pool but you— which is 100% ownership— everyone’s LP tokens are burned on redemption to match your new share.

Now, the purpose of liquidity pools is to “supply” tokens for exchange traders. Hence why it’s always two tokens or more. But market demand is irregular, so if you give 50% of each, how does it maintain that ratio?

Arbitrageurs.

A pool with unbalanced proportions means that there’s a price difference between the pool and real-market assets. Arbitrageurs are users or trading bots that profit from selling across platforms, and this rebalances the 50-50 ratio. This happens within minutes, so providers always have their funds redeemable even though AMMs are constantly “spending” them.

Automated Market Makers are a different smart contract. DEXs use it to calculate what traders should pay for your pool tokens. AMMs are semi-liquid because you can instantly trade almost any token, but rates won’t always be as fair as real markets’.

If you recall, those are the two conditions for liquidity.

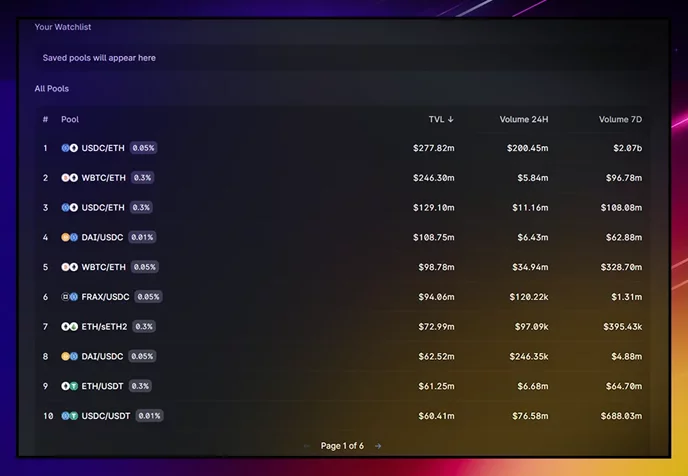

And that’s how DEXs and LP tokens work together. All liquidity that users provide goes to a collective contract wallet, and this amount is called pool value or total value locked (TVL). The DEX TVL is the sum of all pools, and the greater, the more liquid.

How Are LP Tokens Calculated

Knowing what LP tokens are worth can be as difficult as explaining to beginners what they are. Cryptocurrencies are “easier” because you just look at one changing variable, the price. With LP-tokens, there are:

- The price of two cryptocurrencies

- The price difference* between both pool prices and the real, deep-liquidity market

- The changing LP token supply whenever a provider joins or leaves the pool

By the time you calculate the value of 1 LP token, it’s probably changed again. Sometimes their prices appear on DEXs/Etherscan, oftentimes they don’t. It’s also more practical to see LP tokens as share percentages instead of dollar values (another reason is, you get both tokens when claiming your deposit or fee revenue).

The easiest way to calculate is:

1 LP Token Value = Total value you added / LP Tokens received

Let’s say you have $1,000 and provide it to a pool as two tokens. Once provided, you should see the LP token address, which you can add to your (Metamask) wallet. Then you can see your amount. If it’s 10 tokens, each one is worth $100.

This is a simplified method that’s only accurate when calculated right after joining the pool.

If you want to calculate LP tokens without having to join the pool, you have to find the total pool value (or TVL) and circulating supply. The last metric is as easy to find:

- From the list, click on the pool to see its description/details (TVL included)

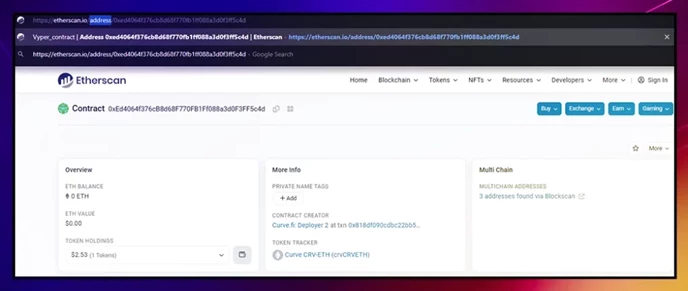

- There should be a pool contract address with a button linking to Etherscan

- Once on Etherscan, on your search bar, replace “/address/” with “/token/” to find the circulating supply.

This seems to work for every DEX except for Uniswap v3 (v2 still works).

And that’s another way to calculate:

1 LP Token Value = Total Pool Value / Total LP Tokens Supply

E.g. A $1M TVL with 100 tokens of supply is worth $10,000 each.

You can also calculate the pool share per token with this formula:

LP Share (%) = 1 LP Token Value / Total Pool Value

Here’s a more intuitive option:

LP Share (%) = 1/Max Token Supply * Tokens Owned

The only metrics you need to calculate rewards are the 24h pool volume and LP share.

LP Tokens Example: Fee Revenue

You want to provide liquidity to a Uniswap pool. For simpler operations, suppose the pool has a total of $10,000 with a 50-50 ratio and fee revenue of 0.1% The pair is USDC-DAI (worth $1 each), so there’s $5,000 of each.

Let’s say you add another 5,000 USDC and DAI tokens, increasing the pool value from $10,000 to $20,000. You should instantly receive half of the LP tokens for contributing 50% of the value.

How many you receive depends on the token settings. It might be one LP token divided in 100, one LP token for every dollar, or an arbitrary max supply like 635. For this example, every token (DAI or USDC) gives you 1 USDC-DAI LP.

For 5,000 USDC and DAI, that’s 10,000 USDC-DAI LPs.

Let’s say this pool receives an average trading volume of $200,000. With 0.1% for fee revenue, the pool generates $20,000 for its providers. Since you contributed 50%, you’d receive a daily $10,000, half in DAI, half in USDC.

What happens if providers join or leave the pool? If new users add funds from $20,000 to $40,000, your $10,000 daily revenue falls to $5,000 (if trading volume doesn’t change). If other users leave and the pool falls from $20,000 to $15,000, you now own 66%.

Every time providers deposit or redeem, they add or remove LP tokens from the circulating supply. Owning 50% means you own 10,000 LP tokens (in a $20,000 pool), which you can redeem to get back 5,000 USDC and 5,000 DAI.

LP Tokens Example: Impermanent Loss Example

Let’s use the same conditions. A $10,000 pool with 10,000 LP tokens, 5,000 USDC, and 5,000 DAI. You add another 5,000 of each for a pool total of 20,000 tokens or dollars.

Let’s say there is worrying news and market trends that make people lose trust in USDC, so they sell it for DAI. Despite the premium, traders keep selling USDC for DAI on Uniswap until the pool has left 4,000 USDC and 16,000 DAI (1:4).

In this case, USDC is worth well over $1 within the pool, so most of the volume would come from arbitrageurs that profit from swapping DAI to USDC (until it’s back to 10,000 tokens each).

Now, imagine all providers burn their LP tokens and leave, giving you a 100% contribution. But the rate is still 1:4. If you first added 5,000 of each, you can now redeem only 2,000 USDC and 8,000 DAI tokens.

This is no problem since we’re providing stablecoins, so it still equals $10,000. Now, imagine there’s something wrong with USDC that depegs from its $1 price to $2. For simplicity, assume there’s no reaction from traders/arbitrageurs, and you want to redeem your 2,000 + 8,000 tokens.

Those 2,000 USDC have turned into $4,000. But if you didn’t join the pool, you’d still have 5,000 USDC instead, which now would be worth $10,000. The impermanent loss or difference is $6,000. This is not necessarily bad if you made over $6,000 in fee revenue.

What happens if USDC falls to $0.50 instead? You would lose less selling 2,000 USDC (worth $1,000) than owning 5,000 USDC (worth $2,500). Instead, you prevent a $1,500 loss by holding more DAI at $1.

Note that whether USDC has a real price of $2 or $0.50, its pool price is still different and likely higher than DAI’s because of its scarcity. Until arbitrageurs step in.

Theoretically, price changes can still benefit liquidity providers. Generally, they don’t because of variable fee revenue, arbitrageurs, and a pool share that’s constantly changing. The ideal scenario is a small pool with high fee tiers and trading volume, where pair tokens are either stablecoins or correlated cryptos with long-term upside potential.

How To Sell LP Tokens

There are many reasons to cashout out LP tokens other than claiming rewards. Maybe there’s a market dip and you want your liquidity back to buy crypto. Maybe your liquidity pool isn’t as liquid as it once was, or it closed, or you found a better one.

Whatever the reason is, you have absolute freedom in selling LP tokens anytime. However, doing so too early can incur more fees as penalties. You could sell them directly on the same exchange, but then you cannot claim the pair of tokens that you provided to that DEX.

The simplest way to sell is to close your pool positions (network fee included), by trading LP tokens for the original tokens and rewards.

You don’t need to worry about losing your tokens on closed pools, because they return to your wallet automatically. Hypothetically, you’ll still hold and be able to sell LP tokens, although they’d lose value or become worthless. Without the pool, tokens have no use, even if there’s another identical pool in the DEX.

If you spend too long holding LP tokens, it’s likely that your token pair ratio has changed. If one token price now is consistently 3x higher than when you provided it (and the second one didn’t change), you won’t be able to redeem the same token amount. It’s called impermanent loss, and it’s the opportunity cost of providing liquidity vs holding.

Impermanent loss undoes if* the ratio recovers. For example:

- USDT-DAI. USDT de-pegged last week, but now it’s back to $1.

- WBTC-ETH. Bitcoin price doubled, but a few days later, ETH also did.

- USDT-ETH. Suppose the rare case where ETH falls by 50% and USDT de-pegs to $0.50. There’s no impermanent loss but price loss instead.

How To Stake LP Tokens

One benefit of LP tokens is that you can trade with them while earning fee revenue from the original tokens in the pool. Some yield-farming tools are riskier than others, so if you lose LP tokens, you lose access to some of your actual funds. If you instead stake LP tokens, you’re still exposed to impermanent loss and price risk, but you never lose your pool share.

Here are three ways to stake LP tokens:

- In-app staking. By default, some apps like Pancakeswap offer tools to stake LP tokens or add liquidity for a locked period. After you receive LP tokens for the pair provided, switch to the respective tab to stake them.

- Stake-as-a-service dApps. Some platforms use staking contracts that support most tokens from that blockchain (LP tokens from Uniswap are still Ethereum tokens). Although the interest won’t be as high and sustainable as if you staked ETH.

- Sell and stake. While not recommended, you could sell LP tokens and buy back later (even someone else’s). E.g., Sell for ETH, stake Ethereum, then un-stake for interest rewards, and buy LP tokens to redeem your original pool tokens. There’s a lot to consider, like the LP token price change, max supply, or if there are fewer buyers than sellers.

Yield farming can quickly add up network and platform fees. Your best choice is the first method, or whichever has the fewest steps.

How To Provide Liquidity on Uniswap

Whether you’re looking for low-risk or more fee revenue, Uniswap is a good place to start. It’s the most popular DEX and pool platform on Ethereum, with an average TVL of 2.5M Ethereum and peaks up to 8M ETH. It’s also one of the earliest DEXs, and whenever the market rallies, it’s one of the first places where traders go.

To provide liquidity on Uniswap:

- Set up your wallet by owning two tokens to provide, plus gas fees. Besides Ethereum, Uniswap supports Layer 2 networks, Polygon, and BnB Chain. Let’s stick to the default option, Ethereum.

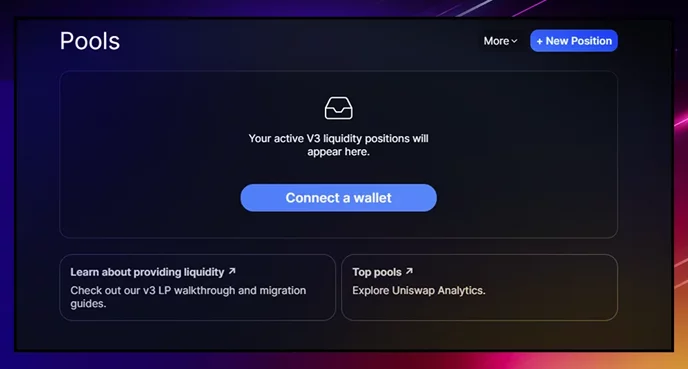

- From app.uniswap.org, go to the Pools tab to create a liquidity position. As for 2023, the top left options are Swap, Tokens, NFTs, and Pools.

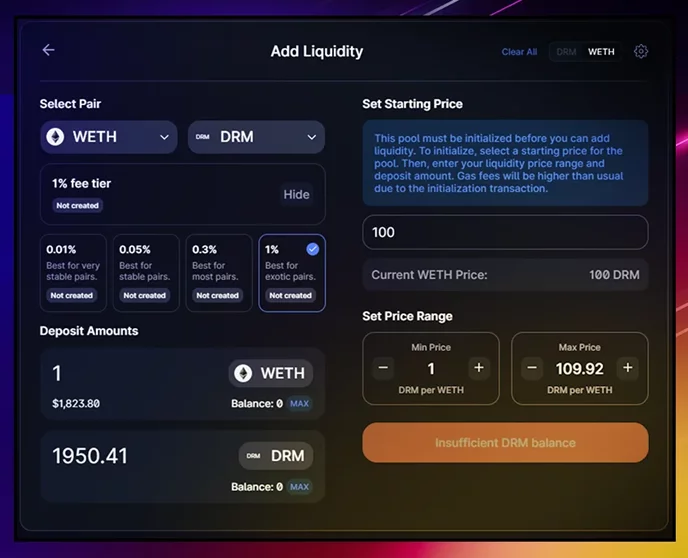

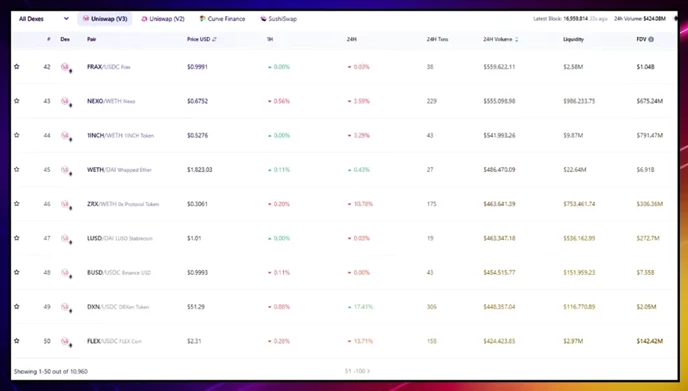

- Find both tokens on the pair dropdown menu and select your fee revenue tier from 0.01% to 0.3%. Assuming all tiers have good liquidity already, the cheapest one receives the most trading volume while the 0.3% is the most profitable.

- Select your deposit amounts (the usual pool ratio is about 50-50).

If you leave all other settings by default, that’s all you need to provide liquidity. Connect the wallet, approve the transaction, and your tokens are now in a Uniswap liquidity pool.

What you see on the right was introduced on Uniswap v3: concentrated liquidity. You no longer have to risk your tokens on unfair trades (like 1 USDT for 1.2 USDC), because you can cap the range to provide. Your position will be on standby and earn no revenue until the rate returns to your range.

The blue area shows the prices where all pool providers allocated their tokens. For example, if most liquidity is concentrated at 1.0000 USDT-DAI, traders might need millions to impact this ratio (e.g., to 1.0010). As the ratio approaches extremes (e.g., 1.002+), it becomes more volatile.

When this happens, traders may choose a more balanced pool with higher fees, and eventually, arbitrageurs restore the 1:1 ratio.

To check the most popular pools, go to Pools > Top Pools:

Now, how do you know when you’re joining someone’s pool or creating your own?

When your joining, you’ll this window:

When creating one, you see this instead:

You create new pools when choosing uncommon token pairs or a fee tier that no one else did yet. Creating will grant you 100% of the pool fee revenue, but getting traders to this new pool can be challenging. Uniswap automatically quotes the one with the best rates.

FAQs

Can You Sell LP Tokens?

If you don’t want to keep your tokens in the liquidity pool, you can always reclaim them and exit. You’ll find the withdrawal feature on the same DEX where you joined the pool. On Uniswap, it’s on the Pools Tab after clicking on your wallet address in the top right corner.

From there, you close your position, pay the gas fee, and get back both tokens.

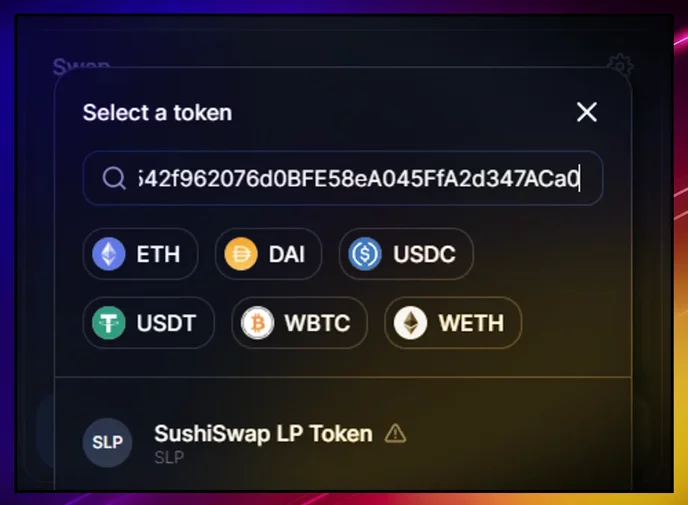

It’s also possible to sell LP tokens directly.

Once you find your contract address on block explorers, you paste it as a custom token, and it should allow you to buy or sell that LP token. They usually appear as “Unknown,” so make sure to double-check the transaction history and name before trading.

It also seems Uniswap can recognize LP tokens from other Ethereum DEXs:

Note that if you trade LP tokens instead of redeeming them on the pool, the rates could be worse.

How Do I Add LP Tokens to Metamask?

Similar to the previous question, you can add LP tokens to Metamask by finding the pair address and buying on DEXs like Uniswap. You buy them with whatever token you choose (USDC, ETH), and they’ll appear in your wallet, often labeled “Unknown.”

Also from liquidity pools, LP tokens instantly appear once your position is confirmed on-chain. To see the amount, you’ll need to add the custom address.

How Do I Lock LP Tokens?

There are two ways to lock LP tokens: 3rd-party lockers and staking platforms. The former is a dApp that allows custom-time locking in a smart-contract wallet for a service fee. Pool creators lock LP tokens because it brings confidence to potential providers to join their pool.

If you’re just looking to maximize idle profits, the latter makes more sense. Staking on DEXs involves liquidity fees, but you’ll also get interest rewards when you unlock those tokens months later.

Can Liquidity Pools Shut Down?

Liquidity pools appear and shut down all the time, except there’s no button to automatically do so. Once LPs remove all liquidity from the pool, its smart contract deactivates. If the original pool creator withdraws, the pool remains open until the last provider leaves.

Closed pools can’t be reopened under the same contract address. If you enter the same pairs and fee tier, you pay initialization fees again and create a different address.

Can There Be Two Identical Liquidity Pools?

It’s theoretically possible within the same DEX but not seen yet. The closest example is Uniswaps pools, which can have the same token pairs but different fee tiers. The only reason to duplicate liquidity pools would be if the former one reached an LP token limit.

When comparing among DEXs, it’s not as uncommon. A DEX aggregator could source from both platforms for better rates.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Max

Max is a European based crypto specialist, marketer, and all-around writer. He brings an original and practical approach for timeless blockchain knowledge such as: in-depth guides on crypto 101, blockchain analysis, dApp reviews, and DeFi risk management. Max also wrote for news outlets, saas entrepreneurs, crypto exchanges, fintech B2B agencies, Metaverse game studios, trading coaches, and Web3 leaders like Enjin.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant