Impermanent Loss in DeFi Explained: What You Need To Know Before Liquidity Providing

Liquidity Providing is important because it allows for trustless trading. If the liquidity pools are large enough, they allow for high volume trading with limited slippage.

Liquidity providing is incentivized by fees. For example, any time a person places a trade through a liquidity pool (on UniSwap or PulseX for example), they pay a fee which goes to the provider.

Most importantly, when PulseChain and Liquid Loans launch, you’ll be able to provide liquidity on pairs such as LOAN/PLS, USDL/PLS, or USDL/LOAN and earn fees.

In order to do this safely you must understand impermanent loss and how to avoid it.

What is Impermanent Loss?

Impermanent Loss is a temporary loss in value occurring when the two assets that you provide liquidity for change in price relative to each other.

If you have no idea what any of this means, check out our article on Liquidity Pools here.

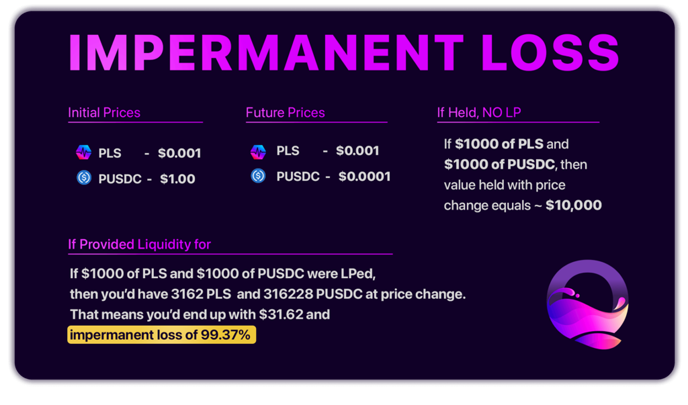

An extreme example of impermanent loss would occur if you provided liquidity for two tokens and one of them went to zero.

Let’s use PLS and pUSDC (since PLS will have non-zero value and pUSDC will likely approach zero due to irredeemability on the new chain).

If this occurred, buyers and sellers would use your liquidity pool to sell all of their pUSDC for your PLS.

As a result, your pool would convert to 100% pUSDC at a price of near zero.

Impermanent loss comes into play because, hypothetically, if you never provided liquidity, you’d still be holding half of your coins as ETH and they’d have a non-zero total value.

What is a Liquidity Provider?

A Liquidity Provider is an entity that decides to add one or more tokens in a liquidity pool to allow for other users to swap tokens using that pool.

For example, a liquidity provider could choose to deposit 1000 LOAN tokens and 1000 PLS tokens into a liquidity pool on PulseX.

By doing this, the liquidity provider is agreeing to allow other users to swap LOAN token for PLS coin or PLS coin for LOAN token within a certain ratio.

Liquidity providers are incentivized to do this despite risk of impermanent loss because of the fees generated every time somebody swaps in their pool.

For example, let’s say a user wants to swap 1000 PLS for 1000 LOAN token using a pool with a 0.3% fee. The trader will be able to do so, but the smart contract will deliver 0.3% of the 1000 PLS (which equals 3 PLS) to the liquidity provider.

Impermanent Loss Explained

Impermanent loss, just like most concepts in crypto, can seem daunting at first but is actually very easy to understand.

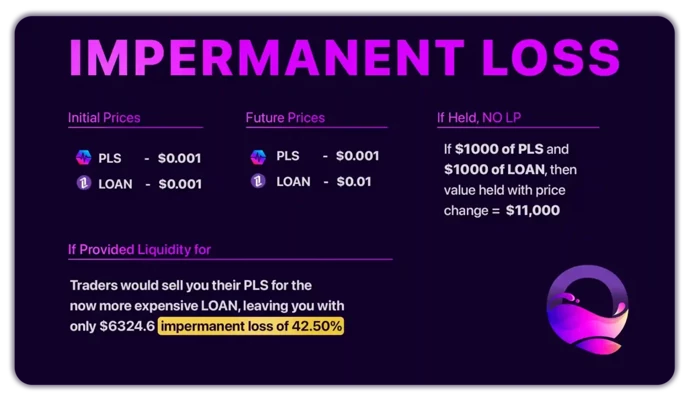

Let’s continue with the PLS/LOAN example.

Let’s say on September 1st, the price of LOAN token and PLS coin are both $1.

Now, on October 1st, the price of PLS stayed at $1 and the price LOAN rose to $1.5.

If you had held 500 LOAN token and 500 PLS coin without providing liquidity, you tokens would now be worth $1,250

If you had provided liquidity, you’d be holding 408.25 LOAN and 612.37 PLS coin, which would now be worth $1,224.74.

The result would be an impermanent loss of 2.02%. In other words, you’d have more value if you had just held the tokens without providing liquidity. However, the fees you make in the process could help offset the impermanent loss.

Impermanent Loss Calculator

If you need help with calculating impermanent loss, you can use our impermanent loss calculator:

If you don’t have a calculator, here’s how you could do it by hand.

- Determine the assets you want to calculate impermanent loss for. For example, you may want to calculate impermanent loss for ETH and DAI.

- Get the current prices of the two assets from a reliable source, such as CoinMarketCap or CoinGecko.

- Ask the user to input the amount of each asset they want to provide liquidity for.

- Calculate the initial value of each asset by multiplying the amount by the current price.

- Calculate the total initial value of the pool by adding the initial value of each asset.

- Ask the user to input the price change percentage for each asset. For example, if ETH's price increases by 20%, the price change percentage for ETH would be 20%.

- Calculate the new value of each asset by multiplying the initial value by (1 + price change percentage).

- Calculate the total new value of the pool by adding the new value of each asset.

- Calculate the user's share of the pool by dividing their initial value by the total initial value.

- Calculate the user's share of the new pool by dividing their initial value by the total new value.

- Calculate the impermanent loss percentage by subtracting the user's share of the new pool from their share of the initial pool, and dividing the result by the user's share of the initial pool. Finally, multiply the result by 100 to get the percentage.

It is important to note that a calculator cannot help you determine future impermanent loss. Nobody has a crystal ball for future price action, so impermanent loss can only be calculated in hindsight.

So since we cannot predict impermanent loss, what are some strategies to avoid it all together?

How to Avoid Impermanent Loss

The goal of a liquidity provider is to generate as many fees as possible while mitigating risk of impermanent loss. There are two ways to avoid impermanent loss:

- Choose two digital assets with highly correlated prices. Liquidity providers often pair two stablecoins together such as USDL and LUSD. If the prices of the two assets do not change relative to one another, there is 0% impermanent loss. The downside to this strategy is stablecoins fees are lower and there is less trading volume than other pairs.

- Single-Sided Liquidity. Liquidity providers will often put only one token into a liquidity pool to avoid impermanent loss. For example, a user might put 1000 LOAN token into an LP with 0 PLS on the other side. If the price moves through their pool, they will be left with only PLS and no LOAN. Therefore, theoretically there is no impermanent loss, rather this acts as a buy order for PLS while generating fees and avoiding slippage.

Can You Have Impermanent Loss with Stablecoins?

Impermanent loss is possible with stablecoins if the stablecoins you hold lose their peg.

To avoid this issue make sure to choose stablecoins that have strong redemption mechanisms and are worth less than the collateral backing them.

For example, USDL and LUSD are stablecoins who always have more than 110% collateral ratio in the form of PLS and ETH, respectively. They have built-in redemption mechanisms which ensure that $1 of the stablecoin is always redeemable for $1 worth of collateral.

Additionally, USDC, USDT, and DAI all have had inconsistent histories of holding their peg to one dollar. If one of these went to zero and you held on LP, you’d end up with no cumulative value at all.

Examples of stablecoin pairs which can experience impermanent loss are UST or AUSD. These stablecoins had flaws in their designs which resulted in them crashing to near zero.

Overall, if both stablecoin hold their peg in your liquidity pair, LPing with stablecoins can be a safe way to earn yield on your dry powder.

Final Thoughts

- Liquidity Providers are a necessary component of a healthy DeFi ecosystem. They are important for facilitating trading between digital assets and setting prices

- Liquidity Providers must be aware of the risks of impermanent loss when setting their LP pairs

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Connor

Connor is a US-based digital marketer and writer. He has a diverse military and academic background, but developed a passion over the years for blockchain and DeFi because of their potential to provide censorship resistance and financial freedom. Connor is dedicated to educating and inspiring others in the space, and is an active member and investor in the Ethereum, Hex, and PulseChain communities.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant