DeFi Aggregators: Effortlessly Get The Best Deal on Decentralized Exchanges

If you’ve ever executed a trade in the DeFi space, you know there are many different exchanges to choose from.

And depending where you go, you could be getting a good deal or a bad deal.

At the time of writing, CoinMarketCap alone lists 22k+ of cryptos and 500+ exchanges. Such a large scope of information is enough to drive an experienced trader crazy, let alone the novices.

So where do you go to avoid the most slippage and price impact?

The answer is DeFi Aggregators.

What are DeFi Aggregators?

DeFi aggregators, aka DEX Aggregators, are platforms that aggregate multiple decentralized exchanges (DEXs) into a single interface. Thus, it makes it easier for users to access multiple DEXs and compare prices across them. It allows users to search for the best price for a specific token or asset across multiple DEXs, and then execute a trade on the DEX that offers the best price.

DEX aggregators are particularly useful when you operate a high diversity of assets, markets, and liquidity pools that the cryptocurrency industry offers.

The goal of a DEX aggregator is to make trading on DEXs more convenient and efficient, as well as providing a wider pool of liquidity for users.

In the world of centralized solutions, Priceline or Expedia are the best analogies to DEX aggregators.

These tools combine traveling and lodging options from a wide variety of sources and present them in the cheapest and most value-packed way.

DEX aggregators act similarly in the space of decentralized exchanges.

Why Decentralized Exchanges (DEXs) Need DeFi Aggregators

DEXes, or decentralized exchanges, enable crypto users to switch cryptocurrencies directly between one another with no central party to interfere in the process.

Such an approach reduces the counterparty risks and contributes to higher security.

Yet, it has its own drawbacks as well.

The lack of liquidity is, perhaps, the worst.

This especially applies to tokens with a small market cap that hold little to no interest to market makers.

As a result, their holders have to struggle with finding good options to buy in or cash out.

This is exactly where DEX aggregators come to help.

These financial protocols connect a large number of decentralized exchanges within a single interface.

They implement complex mechanisms to match the assets in real-time.

Thus, DEX aggregators enable traders to find the best prices and help them make more informed decisions.

How Do DEX Aggregators Work?

DEX aggregators represent a superstructure built on top of existing decentralized exchanges.

Developers use API to connect a huge number of different DEXes on a single platform.

Thus, they create a single point of entry to different markets, assets, and prices.

Thanks to the complex algorithms, DEX aggregators can help crypto users find the best prices and reduce slippage.

It becomes possible to switch larger amounts of crypto without significant price impact.

Besides, such an approach helps users benefit by reducing swap fees and optimizing slippage.

DEX Aggregator Benefits

DEX aggregators have experienced significant growth in the last couple of years.

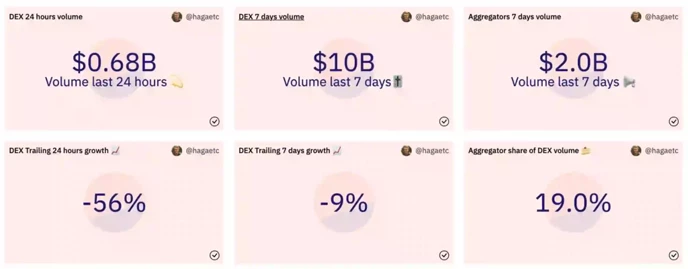

At the time of writing, a crypto analytical platform Dune shows more than $2.1 billion worth of crypto being traded via aggregators over the past 7 days only.

Why are they so popular in the decentralized finance sector? Well, we can list a few reasons.

- Liquidity. DEX aggregators provide traders with high liquidity, even when rare tokens are concerned. With their help, investors can easily convert large numbers of tokens in single window mode.

- Better exchange rates. When all options to exchange a given token are available within a single place, finding the best deal becomes much more convenient as well.

- Lower gas fees. Having various options in a single place, crypto users can select not only the best price but also the lowest gas fees. What’s more, some aggregators offer fee reductions for holders of their native tokens.

- Privacy. Just like traditional DEXes, DEX aggregators do not require users to pass any KYC procedures. All you need to exchange tokens is a personal crypto wallet.

- Security. With DEX aggregators, users have full control over their funds as they store them securely on their non-custodial wallets. This reduces the chances of theft.

With a set of such solid benefits, there’s no wonder why cryptocurrency users now abandon centralized exchanges for the sake of DEX aggregators.

List of DEX Aggregators

As DEX aggregators’ popularity grows, so does the number of such offers. Here is a list of 5 popular aggregators.

1. 1Inch Exchange

Website: 1inch.exchange

1Inch Exchange deservedly bears the name of No.1 DEX aggregator in the whole market. It provides its users with access to the deepest liquidity and the best token swap rates across a large number of decentralized exchanges.

At the time of writing, it combines 200+ sources of liquidity and supports 9 different chains. With the help of its bridges, traders can switch tokens between Ethereum, Polygon, Optimism, Binance Smart Chain, and many other platforms.

1Inch regularly launches gas refund programs. Users who meet specific conditions may return up to 100% of their trading fees every month.

2. Matcha xyz

Website: www.matcha.xyz

Along with 1Inch, Matcha XYZ also represents one the earliest DEX aggregators.

Built on top of the 0x Protocol, it enables its users to leverage 0x smart routing. Its unique technology splits trades across different DEXes to conduct the best order fill. Thus, users are able to find the best prices to swap tokens across different DEXes in one place.

The platform supports Ethereum, Binance Smart Chain, Polygon, Avalanche, and many other blockchains.

In addition, Matcha has successfully passed the audit by ConsenSys Diligence ensuring its high security standards.

3. Paraswap

Website: www.paraswap.io

This is yet another DeFi aggregator that unites the liquidity of decentralized exchanges and lending protocols within a single interface.

The platform claims to support 7 different blockchains, including the most popular options like Ethereum and Polygon. At the time of writing, it claims to have exported over $37 billion worth of crypto.

Paraswap has passed a successful audit by Certik and a few other auditing organizations. Its other key strengths include a robust set of ecosystem integrations and the support of institutional-grade partners.

4. OpenOcean

Website: openocean.finance

This is a one-of-a-kind aggregator that combines liquidity from both centralized and decentralized exchanges.

Its ecosystem covers 18 different chains, 130+ DEXes, 14 wallets, and 12 bridges. The numbers are only relevant at the time of writing, though, as the platform rapidly expands its presence.

OpenOcean features generous referral rewards as it enables users to earn up to 25% free rebates for the friend they invite to the platform.

5. CowSwap

Website: cow.fi

CowSwap makes a step further. It combines not only DEXes, but DEX aggregators as well while protecting its users from front-running or maximum extractable value (MEV) attacks.

Its key innovation enables traders to settle deals without using DEXes. This allows them to avoid slippage and eliminates the necessity to pay any fees at all.

If CowSwap users can’t find a peer to execute a trade right on the platform, the deal is settled on-chain through other liquidity sources that the platform aggregates.

The Bottom Line

DeFi users want the best deal.

DEX aggregators combine liquidity from hundreds of decentralized exchanges to allow users to avoid slippage and price impact.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Kate

Kate is a blockchain specialist, enthusiast, and adopter, who loves writing about complex technologies and explaining them in simple words. Kate features regularly for Liquid Loans, plus Cointelegraph, Nomics, Cryptopay, ByBit and more.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant