Comprehensive List of Crypto Failures in 2022 (They're All Centralized)

In 2022, the crypto industry was hit with centralized exchange bankruptcies, bridge failures, stablecoin depeggings, and much more.

This all led to BILLIONS of dollars lost and people behind bars.

In this article, we are going to review the most prominent crypto failures that took place in 2022 and analyze the reasons why they happened.

Centralized Exchange/Brokerage Failures

Centralized platforms have been ruling the crypto market for the past decade.

With the lack of convenient and efficient decentralized alternatives, end-users, simply had no other choice but to entrust their funds to such enterprises.

And still, centralized exchanges feature significant drawbacks. They lack transparency, suffer from overstaffing, and are unable to keep proper track of their own employees. Worse than that, they are tightly bound by all their external debts and leverage.

In such conditions, there’s no wonder that even minor external problems can cause an avalanche of liquidations and bankruptcies.

Celsius Network, June 2022

Celsius was a centralized crypto lending platform offering its users a chance to earn a yield on their crypto investments.

Two months before its collapse, it claimed to have 1.7 million users and $11.7 billion in assets managed.

Yet, the ongoing bearish market led it to a liquidity crisis as Celsius proved to be overleveraged. Terra’s collapse, in turn, became the final note of its existence.

THE CELSIUS BLOWUP, EXPLAINED.

Huge sectors of crypto are imploding, and crypto unicorns might be coming down with it.

Luna was first, but now $10b giant Celsius is facing insolvency and even bankruptcy.

Let's dive in:

— Jack Niewold 🫡 (@JackNiewold) June 13, 2022

Three Arrows Capital, July 2022

One of the largest centralized crypto hedge funds, Three Arrows Capital (3AC), fell victim to the overall negative conditions of the bear market.

At this, the 3AC collapse followed the failure of Terra’s stablecoin UST as the fund had invested around $500 million in this project.

To make things worse, BTC and ETH price drops resulted in the liquidation of 3AC’s leveraged positions across various protocols.

Besides, the fund heavily borrowed from other crypto companies such as BlockFi, Voyager Digital, Genesis, and Blockchain.com. Thus, its bankruptcy had a heavy negative effect on them as well.

Voyager Digital, July 2022

With a large sum invested in 3AC, the US-based cryptocurrency broker Voyager Digital was the next one in line to go bankrupt.

In addition to 3AC, Voyager had some other unlucky business partners that contributed to its failure. At this, it was heavily bound with Terra, Alameda Research, Celsius, Babel Finance, and many others.

FTX, November 2022

The failure of FTX, one of the top-five crypto exchanges by trading volume, marked the next stage of crypto contagion this year.

On November 2nd, Coindesk published a report that made the community nervous. The document revealed that Alameda Research, FTX’s close business partner, stored the majority of its funds in FTT, the native token of the exchange.

Scared of the upcoming devaluation, users rushed to withdraw their funds from the exchange which led to its liquidity crisis.

To support FTX, Binance first declared its intentions to buy a large amount of FTT, but then canceled its own decision. A few days later, FXT experienced a successful hacking attempt which became the final nail in its coffin.

BlockFi, November 2022

With heavy exposure to FTX, a centralized crypto lending platform BlockFi filed for bankruptcy right after its creditor.

With overall assets and liabilities ranging from $1 billion to $10 billion, BlockFi also had strong ties with Voyager Digital and Celsius Network. Yet, its margin of safety wasn’t enough when FTX followed the same path.

Bridge Failures 2022

Bridges play an important role in the blockchain ecosystem. By minting wrapped tokens, they enable their seamless transfer from one blockchain to another.

The innovative idea truly helps to connect various blockchains and simplifies the usage of crypto in general. Yet, it may easily turn sour when crypto projects select a centralized path of development.

Wormhole, February 2022

A centralized protocol Wormhole acting as a cross-chain link between Ethereum, Solana, and other blockchains, experienced an exploit on February 2nd. The attacker managed to steal around $325 million worth of wrapped ethers.

The hack became possible because of a bug in the code that developers missed before releasing the new version for public usage.

Ronin, March 2022

The Ronin Network became another victim of a successful hacking attempt this year. An attacker managed to get control over 4 out of 9 validator private keys and used one more from Axie DAO.

At this, the protocol lost about $540 million worth of Ethereum and USDC. Should the platform have relied on a more decentralized system, it could’ve avoided such heavy losses.

Harmony’s Horizon, June 2022

This case was pretty much similar to Ronin’s. Hackers managed to put their hands on 2 out of 5 private keys that the bridge required for the validation of transactions.

As a result, the platform lost around $100 million worth of crypto that the hackers later laundered through TCash with no chance of recovery.

Nomad Bridge, August 2022

As the developers of Nomad bridge released a new update with a bug, attackers quickly made use of this vulnerability. At this, they managed to mint 100 wBTC on Ethereum by sending only 0.01 wBTC from Moonbeam.

Earlier this year, the Nomad team released an official blog post stating that they gave up light clients in the platform’s design to avoid their complex implementation. Lower operating costs meant lower security, though.

The results of this decision weren’t long in coming costing the project $190 million.

Binance Smart Chain, October 2022

An attacker discovered a vulnerability in the BSC bridge contract and minted 2 million BNB out of the thin air.

No real user funds were impacted. Yet, hackers managed to transfer tokens to other chains before BSC suspended its network.

Comprehensive security audits could’ve helped the project avoid the hack. But the hack itself is not the worst.

More importantly, the fact that someone has managed to suspend a whole working network in a centralized manner should make users wary. What if this someone decides to block end-users’ funds next time?

Stablecoin Failures 2022

In 2022, there was also a slew of stablecoins which failed as well.

Fundamentally, these failures were the result of not being fully-backed and not have a robust redemption mechanism.

UST, May 2022

Terra’s UST collapse has become one of the largest crypto failures during this unfortunate year. Here’s what happened according to the Chainalysis report:

- Terraform Labs withdrew 150 million UST from the Curve’s pool. Two traders used this temporary vulnerability for their own profits and swapped $185 million UST to USDC.

- Terraform Labs and its supporters tried to rebalance the UST ratio by purchasing it back.

- Their attempt didn’t solve the problem but even made it worse as the large trades broke UST’s peg.

- Investors panicked, and a large sell-off began. UST’s sister token LUNA hyperinflated and led to a total crash of both assets.

Why has the whole situation occurred in the first place? Two key reasons.

First, UST was undercollateralized by its sister token LUNA to absorb the price volatility of UST.

Second, the system lacked the pegging mechanism that would otherwise restore the UST’s peg during the panic-sell.

aUSD, August 2022

Acala Network, a Polkadot DeFi platform, experienced a major attack in August. Hackers managed to mint over $1.2 billion worth of Acala’s stablecoin aUSD without any collateral immediately causing the depegging process.

In response to the black swan event, Acala’s team halted all operations on the platform. That didn’t help much as the aUSD’s peg was never restored after that.

With a single party being able to block operations of the whole network, the DeFi platform doesn’t look that decentralized anymore, does it?

This is what can happen when a protocol is not immutable and the team has admin keys.

Circle USDC, August 2022

In August 2022, the US Treasury sanctioned USDC and ETH addresses connected to Tornado Cash under the pretext of money-laundering activities. At this, a centralized fiat-backed stablecoin issue had nothing else left to do but to comply.

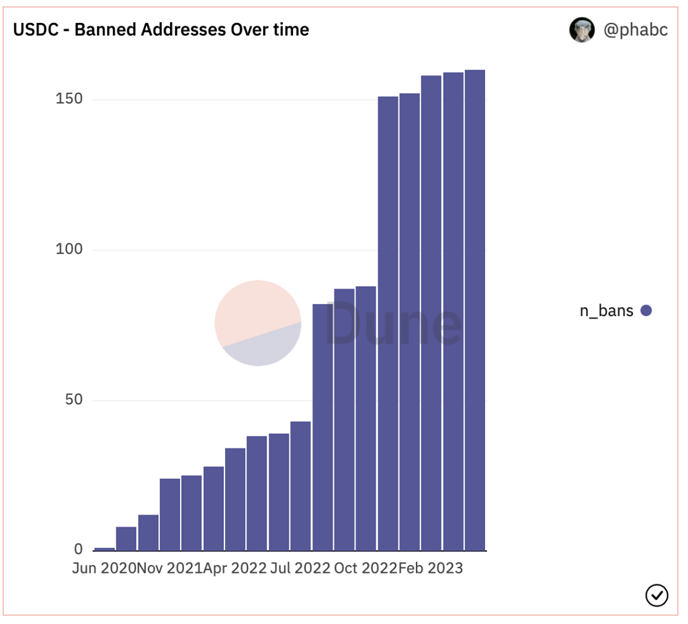

A crypto-analytical platform Dune reported on about 40 cryptocurrency addresses being banned within a single day.

Dune reports on Circle banning ~40 addresses in August 2022

One must always be ready for even the most reputable crypto service to let down its users - in case it is centralized, of course.

How was Circle able to freeze users’ funds that resided on non-custodial wallets? It looks like the project is able to add custom parameters to every issued token and put a veto on specific addresses.

A crypto podcast Empire gives a more detailed explanation in a series of tweets:

USDC blacklisted several Ethereum accounts last week, freezing their token balances.

But aren't token transfers permissionless? Here's how they did it 🧵 👇

— Empire 🟪 (@theempirepod) August 17, 2022

USDT, November 2022

After FTX collapse, law-enforcement agencies made Tether freeze $46 million worth of stolen USDT to help the misfortunate exchange.

While this act looks justified, it also shows how large the scale of power such centralized services have over their users’ funds.

If you think that it’s the first time that Tether plays such a dirty trick, you will be wrong. It has done likewise in January 2022 ($150 million USDT frozen) and earlier in September 2020 ($35 million USDT).

Flash Loans on DAOs

DeFi solutions are deprived of centralization risks, and that’s true. Yet, they may fall victim to other types of sophisticated attacks.

Flash loan attacks represent one of the key dangers in this area.

Blockchain has made it possible to take immediate uncollateralized loans of large sizes and repay them back within a single transaction. The solution known as flash loans has opened the gates to criminal activities.

At this, the top crypto crimes in 2022 include the following three cases.

Beanstalk, April 2022

The DeFi project Beanstalk Farms was drained of $182 million worth of crypto via a flash loan attack.

The malicious actors exploited the vote governance system of the project. By capturing the majority of the voting power, they approved the launch of the code to transfer the funds to their own wallet.

The Redemption, April 2022

Prior to launching a decentralized exchange, a crypto project Redemption applied to Certik to audit its code. On the same day, the platform suffered from a coordinated flash loan attack that drained it by 4 million 2OMB tokens, or $1.6 million USD in equivalent.

The audit later revealed that the smart contract contained a vulnerability. The project simply didn’t have time to fix it before the attack occurred.

Cauldron, September 2022

Another project to bear severe losses due to smart contract vulnerability was Cauldron running on the Avalanche protocol.

According to Certik’s report, the attacker manipulated the token price in the contract and got away with ~$370k worth of profits.

Bottom Line

With the advance of blockchain adoption, the scale of crypto crimes becomes larger as well.

Yet, it’s not the decentralization technology to blame. As you may see, the largest crypto failures in 2022 have occurred to centralized custodial solutions that have control over end-users’ private keys.

Flash loan attacks stand aside from this rule. Yet, it is possible to reduce their effect by implementing decentralized price oracles that provide accurate pricing for various cryptocurrencies.

Crypto has been invented with the primary goal of reducing the power of the centralized institution and giving us back the right to control our own funds. Then why do we still continue entrusting our funds to centralized solutions?

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Kate

Kate is a blockchain specialist, enthusiast, and adopter, who loves writing about complex technologies and explaining them in simple words. Kate features regularly for Liquid Loans, plus Cointelegraph, Nomics, Cryptopay, ByBit and more.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant