Centralized (CEX) vs Decentralized Exchanges (DEX): What You Need to Know

Quick Takes

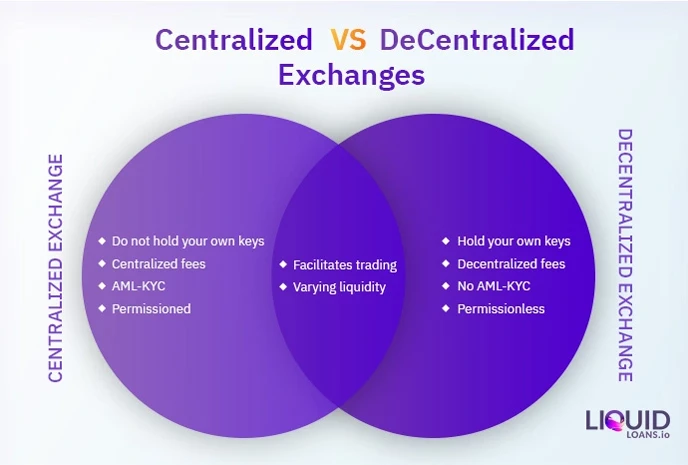

- The fundamental difference between centralized vs decentralized exchanges is not having custody over your coins vs having custody over your coins, respectively.

- Centralized Exchanges are notorious for losing and/or freezing user funds, high middleman fees, and lack of transparency

- Decentralized Exchanges offer peer-to-peer, trustless, and permissionless exchange of digital assets without middlemen.

What is a Centralized Exchange (CEX)?

The first ever crypto trading platforms started as centralized exchanges or CEXs for short. They’re essentially companies that provide trading services, except they manage cryptocurrencies instead of traditional currencies. Like every financial organization, they’re subject to regulations, security checks, and investment insurance (better known in the United States as the Federal Deposit Insurance Corporation).

While they never advertise as such, CEXs are essentially asset managers. Whenever you trade cryptocurrencies from these platforms, you're transferring financial ownership to the company and trusting that they will use your balance as intended. In practice, your money goes to a collective wallet that automatically fulfills everyone's orders.

We call them custodial wallets. Binance, Coinbase, Kraken, KuCoin, eToro, and all CEXs have one.

In finance, trust is backed by legal procedures such as:

- Know Your Customer (KYC) for user's proof-of-identity and proof-of-address

- Anti-Money Laundering (AML) compliance, which is one reason CEXs can offer crypto-fiat services

- Terms and Conditions set by the company that users must follow to avoid balance freezes

Cryptocurrency exchanges (CEXs) are known to be prime targets for hackers and as a result, they invest heavily in security measures. Despite these efforts, there have been several incidents each year since 2012, resulting in some CEXs going out of business. This can be attributed to various factors such as cyber-attacks, debt, or even the unethical act of founders deleting the platform to abscond with investors' funds.

Examples of Centralized Exchanges

Hundreds of CEXs have appeared since Bitcoin's inception (the first one being Mt.Gox in 2010). Many are inactive, others shut down, and some of them have become the most popular exchanges worldwide until today. The top 10 by market volume are:

- Binance (2017) and Binance US

- Coinbase (2012)

- FTX (2019)

- Kraken (2011)

- Kucoin (2017)

- Gate.io (2013)

- Bitstamp (2011)

- Gemini (2015)

- Coincheck (2012)

- Huobi Global (2013)

These tend to offer the most token variety. If payment options and fees are more important to you, the most recommended are national CEXs. For example, there's Voyager for the USA, Newton for Canada, Swyftx for Australia and New Zealand, and CEX.io for most of Europe.

Almost all CEXs are crypto-fiat (otherwise you're better off using DEXs). National CEXs only support the country's official currency while platforms like Binance have the 5-10 most used worldwide. Still, almost every crypto pair is either in BTC or USD, and fiat-fiat pairs are very rare.

Examples of fiat-only CEXs are TDAmeritrade, Fidelity, and Charles Schwab. Those that expanded with cryptocurrencies are the minority (e.g., Interactive Brokers), which is to offer Bitcoin, Ethereum, and three altcoins at most.

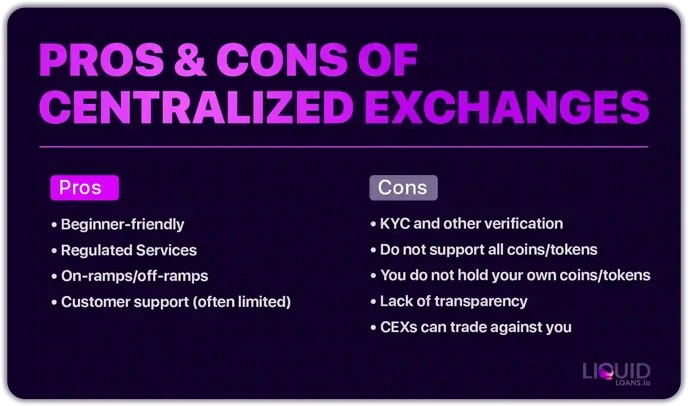

Pros and Cons of Centralized Exchanges

Centralized exchanges are not totally ‘bad', they come with various advantages and disadvantages.

Pros of Centralized Exchanges (CEXs)

What are some of the reasons you might want to use CEXs?

- CEXs are more beginner-friendly. Companies increase revenue and liquidity through adoption, which is why they're simpler and more attractive than DEXs. More exchanges now have minimalistic “Lite” versions to avoid overwhelming first-time crypto buyers. Not every exchange can become Binance, so a different selling point is to make exchanges feature-light, aesthetic, and with many fiat payment methods.

- CEXs abide by regulations. They've been verified to meet basic security standards, which brings confidence to beginner crypto investors. And because they're regulated, CEXs can offer several regulated services that unregulated platforms don't. International CEXs become all-in-one crypto platforms, offering prediction markets trading, lending, debit cards, gift cards, OTC liquidity, margin trading, and crypto-fiat ramps.

- CEXs have the most crypto on-ramps and off-ramps. Provided that you can verify an account, you'll be able to access more payment methods than any DEX provides in 2022. Especially national exchanges offer the most options (but smaller coin selections). CEXs can sell you crypto for fiat(via credit cards, P2P markets, bank transfers, Paypal…) or send you fiat money in exchange for crypto (via bank transfer or cards).

- Beginners also like that CEXs have customer support to guide them through the adoption. Unfortunately, CEXs get a bad rap because companies don't prioritize support enough (there are exceptions), there are more users than agents, and users have unrealistic expectations. Read reviews and carefully decide, because you don't want to have a suspended account and waste weeks on support tickets.

Cons of Centralized Exchanges (CEXs)

While CEXs seem like the best place to start with crypto, it's not a good idea

to stay on them:

- You need constant verification: KYC is the first step that allows you temporary access to the services. You may have to re-upload files every few months or whenever the company updates the Terms. Don't forget there's an algorithm to detect “suspicious” activity, which can suspend your account anytime for the most ridiculous reasons.

- CEXs don't support enough coins. They offer, at best, a few hundred coins and often skip important ones (e.g., CoinBase exchange). DEXs can trade any coin in the blockchain (1000s). CEXs don't list new coins until months later, which puts you in the late investor majority.

- They're custodial wallets. If the founders do an exit scam or there's an important cyber-attack, you will lose crypto. When that happens, they will deny the incident and hide the loss with “temporary” withdrawal suspensions. Also, CEXs can change terms without notice and interpret your compliance. They neither have the obligation to justify account decisions.

- They lack transparency. You don't know how they're using your idle crypto, and you don't know who's behind the trades. A custodial exchange can trade against itself or convert user funds to create fake trading volume and price action. Costs aren't transparent either, as the promoted fees aren't that low compared to the bid-ask spread (e.g., CoinMarketCap shows ETH at $2,000 but CEXs offer it at $2,050).

- CEXs can trade against you. While you don't have transparency, the company can see everyone's orders and capitalize on them (via scam wicks or volume incentives). You might blame the whales when it's really insiders front-running the trades.

These cons aren't theoretical risks. They happen all the time, and several CEXs have gone out of business because of them.

Examples of Centralized Exchanges Failing Their Users

Nobody joins a crypto exchange expecting it to fail. Yet, hacks and exit scams have become so common that the news is no longer surprising. There's a never-ending list of incidents that gets longer every month.

Not only do they lose investor money but tend to drag down all market prices. Here are the most relevant ones:

- Multiple worldwide exchanges had security breaches in 2019. These led to a $40M loss on Binance, +$45M in UpBit, $15M in Cryptopia, and $105M in Coinbene.

Maintenance or hacking? The #Coinbene case: how did the exchange that ranked in the top 10 for transactions suffer a massive #hack to lose $105 million and left more questions than answers to its users.

Here's what happened... 🧵 #cryptohack #historichack pic.twitter.com/rO9WLHKmeC

— NGRAVE (@ngrave_official) March 25, 2022

- After the first major crash in 2018, several platforms shut down without warning. This includes Coinnest, QuadrigaCX, Zaif, Coinrail, Coinsecure, Bitgrail, CoinCheck, BTCChina, and Bancor. Some did because of cyber-attacks, while many used that as an excuse to pull exit scams.

- Even more, exchanges shut down in 2020, either because of regulations, bankruptcy filings, or security concerns. Countless investors still have their funds stuck in BitSpark, CryTrEx, NLexch, TradeSatoshi, FCoin, Excoin, Etherbase, and Altbit.

- The popular Crypto.com was hacked in January 2022. This exchange lost around 5,000 ETH, 440 BTC, and other altcoins worth $34M in total. Had it happened in a bull market, it would have easily been twice as much.

Remember, it’s 34 million dollars in losses that we know about. They could lose way more and just cover it up, announce a new raise or get a bailout from crypto bros.

There’s a bunch of unreported exchange hacks and lost funds, exchanges don’t like to report hacks. pic.twitter.com/dk5ZmfSuuV

— Bitfinex’ed 🔥🐧 Κασσάνδρα 🏺 (@Bitfinexed) January 20, 2022

- KuCoin lost over $280M in a hot wallet breach in late 2020. It still receives a steady 200,000 weekly visits and $800M in daily trading volume.

- Two pseudo-DeFi platforms added to the 2022 list: Celsius (CEL) and Three Arrows Capital (3AC). Both held billions of user assets and borrowed even more from Voyager, BlockFi, and other lenders. Once they were unable to repay the loans, both filed for bankruptcy, dragging investors, lenders, and market prices.

But that's not all:

- Out of the Top 20 biggest exchanges, practically all of them had security breaches from 2016 all the way to 2022.

- Even though crypto seems safer than ten years ago, hacks and scams are as common as they've always been.

- Centralized exchanges rarely admit cyber-attacks. When they do it's already too late to take action. Or they may wait for low market prices to share the news, so it seems they lost far less than in reality.

If you think you still need more proof before making conclusions, here you can find a detailed report of all exchange failures to date.

At least 35 crypto exchanges are no longer with us. And while there are around 300 still active, less than 50 exchanges have enough liquidity, trading volume, or security. Knowing that most of them were hacked or might be eventually, what does that leave us with?

Decentralized exchanges.

What is a Decentralized Exchange (DEX)?

If CEXs are about trust and legal compliance, DEXs are about trustless systems and code. What makes an exchange decentralized is the ability to disperse control. When the platform doesn't have a central node, it's more difficult to breach its security, change the rules, or shut it down.

Note: CEXs have several nodes too. But if the same company controls multiple devices/locations/wallets, it's NOT decentralized. It's distributed. DEXs are both.

The main difference between both is control.

In CEXs:

- Company leaders make the decisions.

- Services and security depend on the servers they own.

- Your funds go to their many wallets or bank accounts.

In DEXs:

- Either developers or decentralized organizations (DAOs) make decisions.

- Decisions are regulated and “enforced” by autonomous code (called smart contracts).

- DEXs leverage developer blockchains like Ethereum, which is a decentralized server owned by no one.

- Your funds stay in your wallet until you exchange them. Also, DEXs have wallets where only smart contracts can manage the funds.

e.g., Governments can shut down a DEX website. But the application will be live and running for as long as the underlying blockchain is. It's like trying to delete the Internet.

Technically, DEXs are applications built on public blockchains that support smart contracts (like Ethereum), AKA decentralized applications (dApps). CEXs are registered companies with private infrastructure.

Examples of Decentralized Exchanges

DEXs have been around for as long as DeFi (since 2018). CEXs, since 2012. Yet, there are now hundreds of DEXs across different blockchains, and soon there will be more than CEXs.

The best DEX examples are:

- Uniswap v3 and dYdXx for Ethereum

- PancakeSwap and BiSwap for BNB Chain

- Raydium and Orca for Solana

- TraderJoe and Pangolin for Avalanche

- SpookySwap and SpiritSwap for Fantom Network

- Sun.io for Tron

- Quickswap for Polygon (Ethereum sidechain)

- PulseX for PulseChain (the first fork with the full system state of Ethereum)

Not to forget multi-chain DEXs like Curve.fi and Sushiswap.

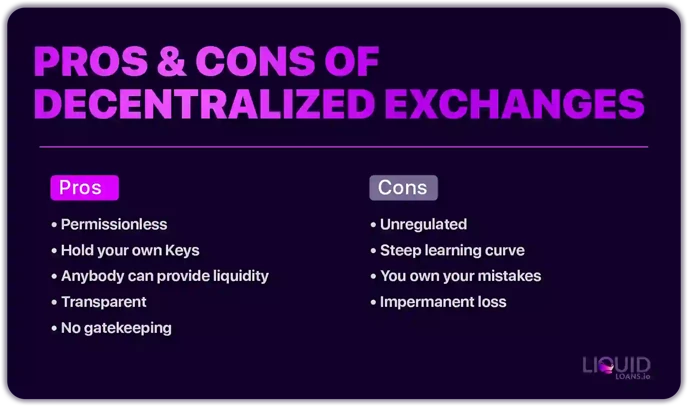

Pros and Cons of Decentralized Exchanges

Much like centralized exchanges, decentralized exchanges have both advantages and disadvantages.

Pros of Decentralized Exchanges (DEXs)

No matter which DEX you choose, the advantages you'll get can't be found on traditional CEXs. The same goes for the cons, although the pros outweigh them overall:

- DEXs are permissionless. As long as you have some coins in a Web3 wallet (e.g., Metamask), anyone can instantly trade on any DEX. Not only are they permissionless, but they can't be restricted. Governments can't exclude people from joining, nor can they shut down the dApp, or impose KYC procedures.

- DEXs are non-custodial. In fact, no one can access your wallet unless you reveal the seed phrase to someone. The only time DEX can interact with your wallets is after you sign a smart contract (which is essentially a pop-up with a Confirm button). So in the remote chance that a DEX is shut down or hacked, you still keep the funds with yourself.

You can think of it as local shopping. Using DEXs is like using your physical wallet to buy items in a shop. No matter what happens to the shop, you still keep your wallet. Using CEXs is like sending someone else to the shop with your wallet and trusting that they will buy what you told them.

Likewise, you can use the same wallet in different DEX (“shops”), while every CEX (“delegates”) that you trust needs a different wallet.

- Anyone can provide liquidity. You do it anyway on CEXs, except they don't tellyou (and without compensation). DEXs make trading possible with liquidity pools, which are idle tokensthat investors deposit for interest rewards. If there are coins you want to hold for their futurepotential, you may as well send them to a DEX pool and earn passive interestrewards.

- DEX transparency is crystal clear. You can see exactly how many users and tokens are inevery liquidity pool. You see the daily volume per coin as well as the total value locked (TVL). You caneven browse the DEX contract on Etherscan to get a full history of the latest wallets that madetransactions, along with their balances, destination addresses, tokens, and actions in other dApps.

- DEXs have more tokens and trading opportunities. You can buy anytoken as soon as the contract is public (e.g., in CoinMarketCap). Many of them arescams, and some of them are gems. If it's the latter, your only chance to buy early is throughDEXs. Some CEX might have 1000+ tokens, but it's very rare to find coins outside the Ethereumecosystem. Not in DEXs.

Cons of Decentralized Exchanges (DEXs)

While DEXs create a lot of investing freedom, it's not for everyone (yet):

- DEXs are unregulated. Which sounds great, except that no one can stop scammers from running rug pull platforms, fake tokens, and phishing sites. It's nowhere as risky as the Wild West it was in 2020, but it's still not as safe as it can be.

- DEXs have a steep learning curve. For someone who never bought a Bitcoin, DEXs aren't as straightforward as CEXs. You have to download and create a Web3, then buy crypto from a regulated platform (verification process included), then transfer funds to the wallet, and use the DEX. It's easier the more you do it, but it's because of this learning curve that most buyers are CEX users.

- You own your mistakes. “No one” is running the DEX, so no one can control or revert transactions. You just lose money, learn from trial and error, and hope to avoid it next time. Support teams can help you with information to avoid costly mistakes. But they can't control the DEX (not even the governments can stop dApps from running).

- Interest rewards may turn into losses. Impermanent loss is the money you would have if you held your coins instead of locking for interest. When prices change, you get back a different token proportion and total value. When there are not enough liquidity providers, there will be more slippage when exchanging tokens.

Are DEXs Better Than CEXs

As for 2023, both DEXs and CEXs are relevant. DEXs add financial utility to crypto while CEXs make it more accessible. Thus, beginners and advanced traders will prefer centralized and decentralized exchanges respectively.

Should you stick to a single one? Not if you know how to manage the cons. CEXs are convenient and safe as long as you use multiple and don't use them as savings accounts. DEXs offer far more than CEXs with more control over your coins.

As for crypto ramps, they're not as essential for DEXs because of the growing number of P2P platforms and businesses that accept crypto payments.

Final Thoughts

CEXs have a long history of going bankrupt and losing customers funds.

DEXs do not have this problem since they do not accept deposits.

DEXs are aligned with the ideals of "True DeFi" which means no middlemen, no admin keys, no governance, and self-custody of funds.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Max

Max is a European based crypto specialist, marketer, and all-around writer. He brings an original and practical approach for timeless blockchain knowledge such as: in-depth guides on crypto 101, blockchain analysis, dApp reviews, and DeFi risk management. Max also wrote for news outlets, saas entrepreneurs, crypto exchanges, fintech B2B agencies, Metaverse game studios, trading coaches, and Web3 leaders like Enjin.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant