CBDC Tracker: Most Important Insights for Each Countries Central Bank

Central Bank Digital Currency, or shortly CBDC, is a digital form of fiat money.

Such currencies have a lot in common with digital assets like Bitcoin.

Yet, they have some central authority’s support and therefore are fully legalized.

The benefits that CBDCs have in comparison with traditional fiat are aplenty.

Just like Bitcoin and other cryptocurrencies, CBDCs feature instant cross-border transactions at negligible fees, full transparency, accessibility, and financial inclusion for unbanked citizens.

However, the rigidness of governmental structures makes the process of their adoption pretty slow.

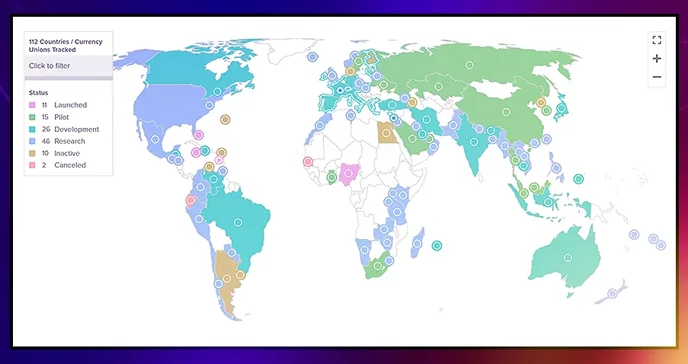

At the time of writing, the Atlantic Council CBDC tracker shows only a small handful of countries that have officially launched their own digital currencies.

Alas, the progress is so slow.

But still, the overall improvement is obvious as central banks of many other regions consider implementing this new technology, too.

Let’s check the CBDC tracker to study the current status of the most viable projects.

Retail vs Wholesale CBDC

An important aspect to consider when exploring CBDCs is who is their primary audience.

At this, CBDCs can be categorized into two broad types:

Retail CBDCs

These are digital assets backed by governments and used primarily by businesses and their customers for daily transactions.

Such assets eliminate the risk inherent to private digital currencies that can stop functioning when their issuers go out of business.

In addition, retail CBDCs may be token-based or account-based.

The first ones are accessible via private and public keys, just like other cryptocurrencies like BTC or ETH.

Account-based CBDCs, in turn, require users to pass full digital verification.

Wholesale CBDCs

The role that these assets play is similar to traditional reserves of a central bank.

Various institutions get permission to deposit their funds in central banks.

The last ones, in turn, may use those funds for their own goals and thus influence lending rates.

Unlike retail CBDCs, these ones are primarily used for large-scale transactions between institutions.

An interesting fact is that, according to CBDC Tracker, only 11 countries are currently developing wholesale CBDCs.

The remaining 56 look out for retail options.

Atlantic Council’s CBDC Tracker: a useful source to check the relevant status of the most interesting projects.

CBDC Tracker Overview

The authorities of many countries are actively researching and developing their own CBDCs.

According to the Atlantic Council, 105 countries are exploring new technology at the time of writing.

In May 2020, this number was much more humble as only 25 countries were considering CBDCs.

Some regions are only starting to look toward CBDCs’ implementation, others are already halfway through.

The aforementioned Atlantic Council CBDC Tracker provides the most relevant information on the status of these projects worldwide.

Let’s review some of them.

Which Countries Have Launched a CBDC?

Launching a new type of payment for a whole country is a truly challenging task.

So far, there are only 11 regions that have switched the official payment system to the blockchain rails:

- Jamaica. Bank of Jamaica expressed its interest in the new technology in 2020. Two years later the final version saw the light in the form of a digital asset JAM-DEX backed by a technological company eCurrency Mint. Thus, the country has become the pioneer in making a CBDC legal tender.

- Bahamas. This small Caribbean country launched its own token backed by the government in 2022. The final release followed the successful pilot that took place 3 years earlier. NZIA Limited is the technology provider that the Bahamas’ authorities selected for the creation of the Sand Dollar.

- Nigeria. This country has become the first one on its continent to launch a digital asset eNaira fully backed by its government. The announcement and the pilot release came out in 2022. The project relies on the permissioned blockchain developed by Hyperledger Fabric.

Other remaining 8 regions belong to the Eastern Caribbean conglomerate which covers small island countries like Dominica, Saint Lucia, etc.

Which Countries Have Piloted a CBDC?

The list of countries with a pilot status of CBDCs is much broader. Let’s review some of the most notable cases:

- Singapore. The Monetary Authority of Singapore announced the development of the new project in 2022. The government targets three goals as it explores the usage of AMMs for wCBDCs, investigates a more efficient way of cross-border payments, and studies wCBDC governance models.

- India. The Reserve Bank of India aims to create a digital version of the Rupee with the key motive to increase the general awareness of digital currencies.

- France. As the project started with a proof-of-concept in 2016, its official announcement came out three years later. The digital currency France CBDC is only experimental, though, as the local government doesn’t yet plan to implement it for commercial purposes.

Other regions include China (e-CNY), Ghana (e-cedi), Canada (Jasper), South Africa (Khokha 2), Russian Federation (Digital Rouble), and Uruguay (e-Peso).

Also, the United Arab Emirates and Saudi Arabia work on a unified digital currency Aber.

Which Countries Are Developing a CBDC?

The list of regions where CBDCs are at the POC (proof-of-concept) stage includes Turkey (Digital Lira), South Korea (Digital Won), Norway (Norway CBDC), Kazakhstan (Digital Tenghe), Iran (Crypto-Rial), Brazil (Digital Real), and Thailand (Digital RealThailand CBDC).

All these countries officially announced the development of their local CBDCs in 2022.

Some other regions that joined the race earlier include Taiwan, Israel, Japan, Sweden, and many more.

Which Countries Are Researching a CBDC?

The list of countries that are only researching CBDCs and how they can make use of this technology is way broader.

It may require a few pages to list them all.

Therefore, we are going to mention just a few of those: Sri Lanka, Nepal, Namibia, Laos, Indonesia, Hong Kong, Chile, and Australia.

Which Countries Are Not Developing a CBDC?

The regions that first announced the development of CBDCs and then for some reason canceled their projects include the Philippines, Haiti, Denmark, Ecuador, and Finland.

Notable CBDC Projects

Now let’s shed a bit more light on the most interesting cases that have the highest chances of getting adopted at scale in the nearest future.

Project Helvetia

Switzerland has long had a reputation as the most secure vault for institutional investors worldwide.

The Swiss National Bank (SNB) has been exploring new means of storing and transferring value since 2020.

In January 2022, it successfully tested the integration of wholesale CBDCs.

Its key partners, International Settlements and SIX Digital Exchange, helped to integrate the new solution with the banking systems of five commercial banks.

As a wholesale CBDC, Helvetia serves mostly the interests of the Swiss Central Bank.

At this, the key use cases of this currency include various operations with wCBDC such as its issuance, redemption, reconciliation, etc.

Project Aber

Aber is another CBDC for wholesale payments with the joint forces of Saudi Arabia and the UAE standing behind its creation.

The key goal of the project is to create a digital currency to be used between the central banks of these regions and a limited number of selected financial corporations.

Initially launched as a pilot in 2019, the project went through various tests.

The Saudi Central Bank published the results on its official website a year later.

It looks like the project has been successful as the countries are moving on with its further implementation.

eNaira

Nigeria has become the first African country to launch its own digital currency.

The retail CBDC called eNaira was initially introduced on October 25th, 2021.

The locals didn’t express a lot of enthusiasm about this event, though.

In November 2022, Bloomberg reported that out of 211 million of Nigeria’s citizens, less than 0.5% were using the eNaira digital wallet.

To push the usage of digital currency, the Nigerian government banned cash withdrawals over $225 per week in December 2022.

Project Dunbar

This international CBDC brings together the collective knowledge of several central banks from different regions.

The list includes the Reserve Bank of Australia, Bank Negara Malaysia, the Monetary Authority of Singapore, and the South African Reserve Bank.

The multi-CBDC platform features international settlements aiming to facilitate cross-border payments across these countries.

At the time of writing, the project is at its pilot stage.

The information about its progress is very scarce, so it’s too early to make any conclusions.

CBDC Issues

Despite all the advantages, the new payment method is not ideal.

Thus, the regions that have made good progress while implementing CBDCs have come across significant problems as well.

Here’s what authorities struggle with:

Interoperability

Just like with cryptocurrencies running on public blockchains, CBDCs face the interoperability problem.

The citizens of a selected region would easily make payments within this region.

But if they decide to send money abroad, the lack of user-friendly blockchain bridges may become a serious obstacle.

Adoption

The lack of general education may also prevent CBDCs from getting adopted at scale.

If citizens don’t understand the real value and the benefits they may get with the new type of currency, they simply won’t use it.

Nigeria comes forth as a good example here.

The local authorities use harsh methods as they ban the use of traditional money to make people switch to the blockchain. Will these methods work?

Only the time will show.

Surveillance/Censorship

Issued by central banks, CBDCs remain a highly censored payment method.

Yes, they have adopted some benefits of Bitcoin and other cryptocurrencies.

But they will never provide their users with the same level of freedom.

CBDC transactions can easily be banned by central authorities at any time.

Bottom Line

High popularity of Bitcoin and other cryptocurrencies makes authorities keep up with technological advancements.

CBDCs may become a good alternative to fiat money.

Issued by central banks, they feature the same level of censorship as traditional banks.

Yet, the benefits that they provide are obvious even to the rigid authorities.

As more countries test the new payment method, there’s a good chance that we may see a brave new world with instant cross-border payments pretty soon.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Kate

Kate is a blockchain specialist, enthusiast, and adopter, who loves writing about complex technologies and explaining them in simple words. Kate features regularly for Liquid Loans, plus Cointelegraph, Nomics, Cryptopay, ByBit and more.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant