How To Read A Crypto Whitepaper (And Know If Its BS Or Not)

If you’ve ever read a crypto whitepaper, you’ll understand it’s often not an easy and enjoyable experience. Text walls full of buzzwords, math functions everywhere, and flow charts that leave you more lost than when you started.

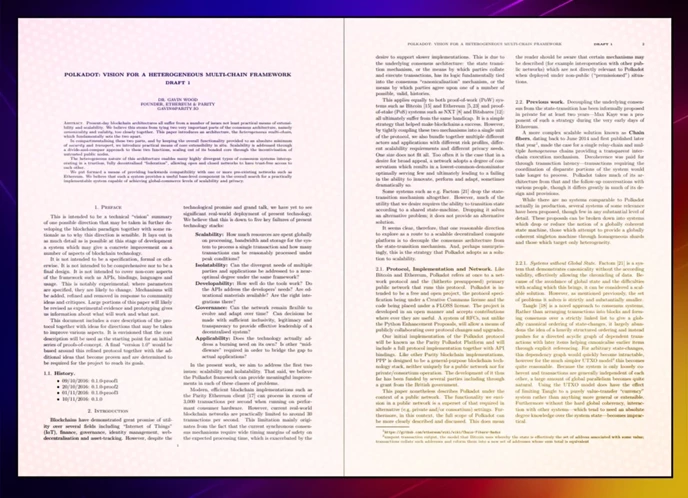

An example is the Polkadot Whitepaper, one of the most complex you’ll likely find. Hieroglyphs would make more sense for the everyman.

But not every paper has to look like a scientific report from the 19th century.

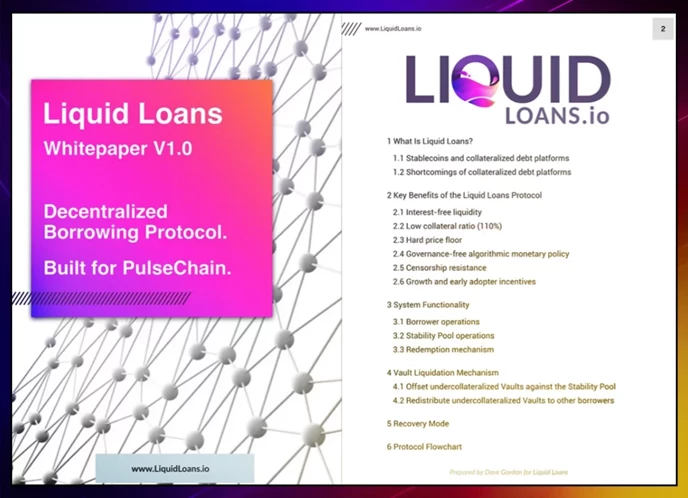

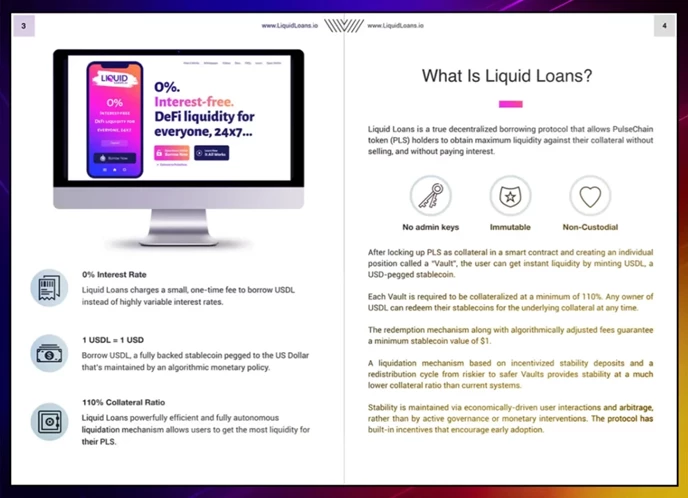

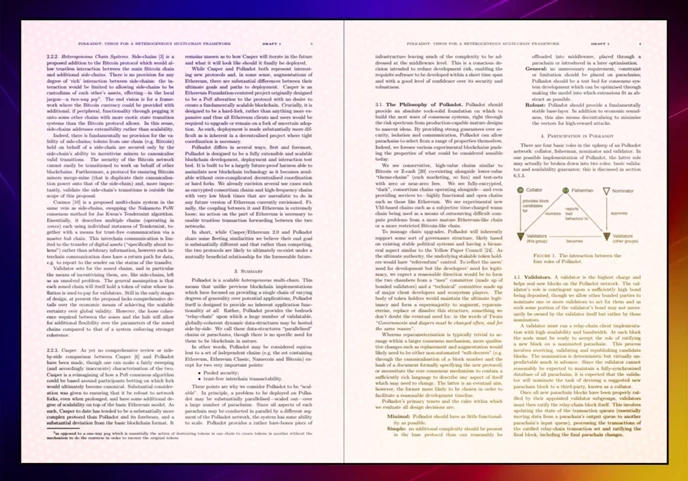

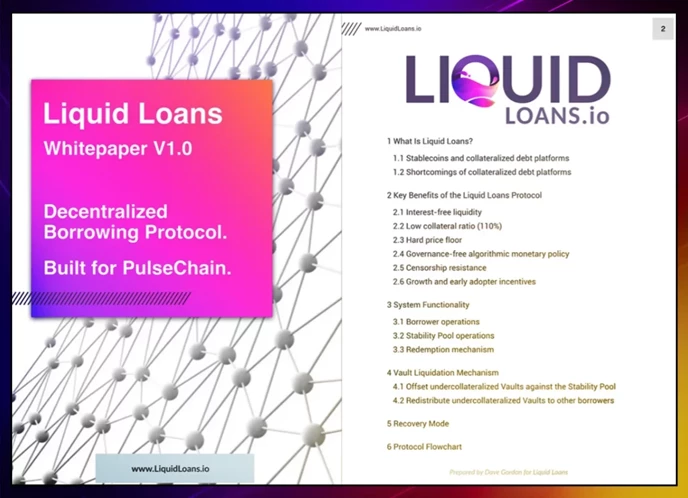

Here’s another example, the Liquid Loans Whitepaper:

Sure you agree that even at a glance it’s much clearer…

Whitepapers come in all shapes and sizes, but sadly, some of the best cryptocurrencies are “locked” behind complex tech papers. And to find out if “that one coin” is the next Bitcoin or not, you need the whitepaper to uncover the secrets.

The good news is, you don’t need much technical knowledge. All you need to know is where to look for the things that make a project good or bad.

And hopefully by the end of this guide, whitepaper reading feels less like the first example and more like the second.

Quick Takes

- A whitepaper should explain a solution created for a problem in crypto. The author explains how the tech works, the token (and why it’s needed, if any), and what it looks like once launched. They’re published before the Initial Coin Offering (ICO) for the review of early investors.

- Crypto whitepapers show different structures, use-cases, token economies (tokenomics), flow charts, teams, and roadmaps. All these parts can help you detect scams

- Whitepapers compress information already present in the website Documentation. Depending on the goals, not every investor has to read the whitepaper.

What Is a Crypto Whitepaper?

To know what you should expect, let’s start with the whitepaper definition:

Whitepapers are highly informative research documents. Authors follow a methodical style supported by: logical statements, industry background, mathematical reasoning, and data references to computer-science authorities. The goal is to explain to experienced investors how the crypto project solves an important problem.

Why is it called a whitepaper? You can think of it as the white lab coat of a scientist. The reasoning behind whitepapers does look a lot like the scientific method. White means logic.

In crypto, whitepapers are slightly different from business plans:

- They follow a problem-solution angle with some background on why it matters.

- They show how the “solution” works, its benefits, and the summary.

- Depending on whether it’s a finished product or not, there may be a roadmap for future goals.

- They also explain the economy involved in the process.

For whitepapers, that’s the number of tokens and their distribution. For business plans, that could be the income model or the number of stock shares to sell on Initial Public Offerings (IPOs). Similarly, whitepapers help developers gather funding for Initial Coin Offerings (ICOs).

When the first token goes for sale, when the media doesn’t know about it, when there’s no trading volume, the whitepaper leads the investors’ decision.

Who Cares About WhitePapers?

Did you read the whitepaper of every cryptocurrency you ever bought? You’re not the only one.

Whitepapers are a bit like crypto audits. They’re great to have. They help with marketing, gain developers’ approval, and prove that your project is secure. We assume they’re professional and well-founded.

Now, should you in-depth research every coin you use? Not even Vitalik Buterin does that. Out of millions of crypto users, pretty much anyone you ask doesn’t know enough about whitepapers— let alone understand the whole thing.

Here’s why most whitepapers suck. When they’re not plagiarized from Ethereum, they’re outsourced from Fiverr. And at best, it’s a geeky ramble about heterogeneous multi-chain frameworks and whatnot.

Only a few make the cut.

And you should read in very specific situations. For example:

- You want to be the first one to buy this new token and there isn’t enough info out there.

- You can’t decide between two awesome projects that seem to do the same thing.

- You’re a value investor ready to put big bucks into the right project.

- You’re a dApp developer trying to learn about your blockchain.

- You’re a governance forum contributor preparing an improvement proposal.

- You work for a crypto audit agency.

- You’re a crypto whitepaper writer.

That’s not to say you shouldn’t have a look anyway. But if you feel like the whitepaper is overwhelming— and you’re not on the list above— we’ll later show simpler alternatives you can try.

Now, there are two parts of whitepapers everyone can and should read.

What Are The Parts of a Whitepaper?

White paper reading is much less overwhelming when you look at them piece by piece. Some are more scannable than others, and not every white paper is going to include every section. It depends on whether you read a problem-solution paper, numbered lists, backgrounders, or other structures.

The two essential parts are the executive summary and the conclusion. Crypto whitepapers typically follow this sequence:

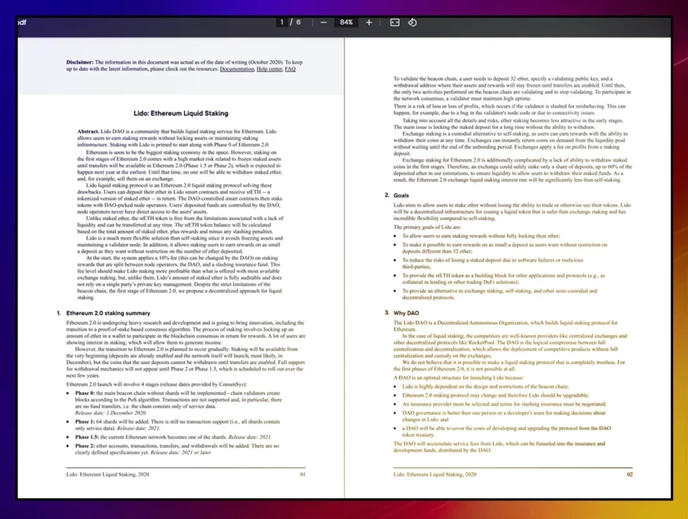

- Executive Summary or Abstract*. It’s essentially a litepaper within a whitepaper. It’s the most concise, brief, and complete description of the white paper.

- Background*. Some papers first introduce the context before their solution. This may include the market overview, problem definition, purpose, glossary, or mention of other projects (e.g., Bitcoin).

- Project Description. Here’s what the project is, its features, how they solve the problem, and all related benefits to its solution. If done right, readers should be able to tell what makes it different from other projects without reading further.

- Systems Overview. It’s a list of the different functions designed along with their technical reasoning. It’s intended for developers to see how each feature interacts and prevents security threats.

- Tokenomics. This section describes the token utility, its supply, market behavior, and how it’s generated. Bad tokenomics can slow down or even wipe out the most innovative protocols.

- Roadmap*. Unless it’s a finished product, the project should have a list of future developments either on the paper or websites. If it’s a centralized cryptocurrency, the Team section should also appear next.

- Conclusion. It summarizes the team’s message and sets expectations about the project once it goes live.

(Parts with asterisks are often omitted.)

Now that you know how whitepapers work, let’s find out whether you should skip the project or have a closer look.

5 Pros to Look For in a Whitepaper (With Examples)

Assuming every project has a whitepaper— and the authors know their stuff— how do you know which one is worth your attention?

There are five details to look for, which also show how to write good whitepapers:

Message Delivery

Think back to the first white paper example:

And the Liquid Loans Whitepaper:

Notice the contrast in message delivery. It’s not just a simpler design, but the message is concise and solution-oriented. Liquid Loans describes what, how, and why in a way that barely needs technical knowledge.

Warren Buffet used to say “Invest in what you know.” Given both whitepaper examples, which one are you more likely to understand?

Clear message delivery brings more potential investors and developers to the community. The paper shouldn’t be a pitch deck, but it doesn’t have to be a scientific report either.

Use Case With Product-Market Fit

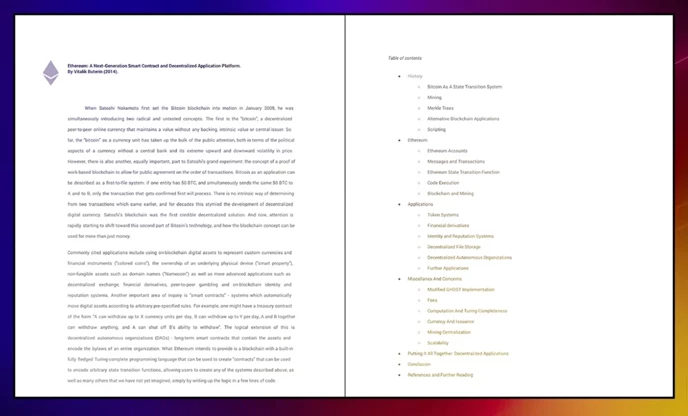

The Original Ethereum Whitepaper is a good example of product market fit:

This is 2015. When there was barely any knowledge about crypto and what blockchain could mean beyond payments. Vitalik Buterin wasn’t trying to offer better payments than Bitcoin. Instead, he addressed different problems in web development and applied the blockchain principles to Ethereum.

By contrast, many projects try to impress investors by doing everything but nothing innovative. Shiba Inu, for example, is a meme-coin that’s building a blockchain, a Metaverse game, NFTs, a DEX, and staking tools. AKA a Rube Goldberg Machine:

Product market fit refers to a problem that many people are willing to pay for a solution that hasn’t been solved by others yet.

It doesn’t have to be inventive. Liquid Loans, for example, offers DeFi tools already present on Ethereum, but on another blockchain that doesn’t have them yet. Every blockchain is a different market.

Coherent Tokenomics

It’s common knowledge that currency supply affects its value. Governments print money to mitigate debt, which also devalue fiat currencies. Something similar can happen in crypto, except it’s more volatile.

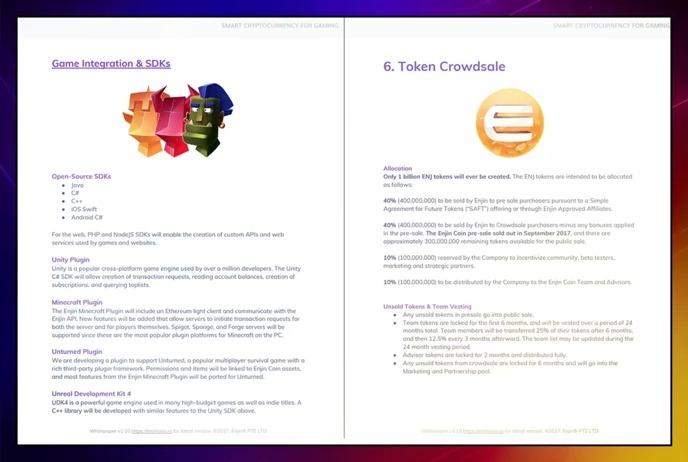

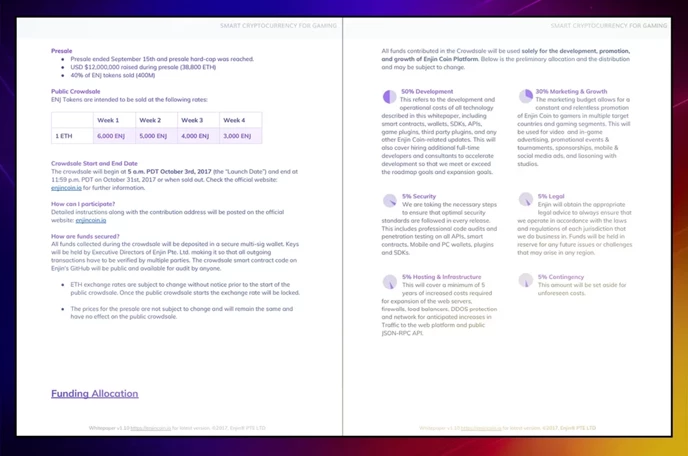

Let’s look at the Enjin Coin Whitepaper example:

You can see it’s very transparent by showing:

- How many tokens exist

- Where tokens go

- How many are tradeable

- How the platform makes revenue

- How the token improves its utility

- Great token allocation for private and public sales

As a result, the ENJ circulating supply is very close to the maximum supply. Not only does the team own <10%, but no one can mint new coins that would devalue the token.

Many projects do the opposite: low token circulation and billions in max supply. They do so to inflate the market cap, a vanity metric that makes investors overestimate the project. And founders may secretly hold admin keys to use wallets that only smart contracts should access.

An Experienced Team

An experienced team tells you a lot about their potential success. Some popular projects today are Cardano by Charles Hoskinson, PolkaDot by Gavin Wood, and Metamask by Joseph Lubin. They are all co-founders of Ethereum who eventually branched out and created world-class products.

The more centralized a blockchain is, the more the team matters. The USDC Whitepaper does that with great detail:

If it doesn’t appear in the white paper, it might be on the website. It’s not recommended to invest in anonymous projects, although there are exceptions like Bitcoin.

A Technical Roadmap

The roadmap is the clearest difference between a real project and scams. Not every protocol needs one, and they’re rarely realistic (Ethereum 2.0. Is YEARS overdue on its promises). Some are finished projects, and others update based on community governance proposals.

Roadmaps are not marketing agendas. It should be a technical plan for future upgrades. The Sandbox Whitepaper did it right:

This roadmap starts after August 2020, which is when The Sandbox published it. Everything before those are past achievements that reinforce the investors’ belief that they will accomplish the next targets.

The planning effort of the roadmap— whether it happens or not— can tell you if the team is here for the long term or a cash grab.

Common Red Flags in White Papers (With Examples)

It’s easier to notice when something is wrong than when it’s right. A lot of “good” tokens launched in 2017 and vanished into oblivion within a year. And when markets are doing good, it’s hard to see which ones are bad.

If a project shows two of these red flags, you should look to invest somewhere else.

Vague Language

There are two reasons white paper reading is difficult. One is the technical reasoning that comes from computer experts. Then there’s the mumbo jumbo coming from someone trying to sound smart. Or at least, discourage criticism.

You see, even without technical knowledge, you can recognize when a paper is specific or vague.

This is specific:

After reading a bit, you can catch nonsense lines like:

“...Basic functions such as production, cross-country trade, general distribution, efficient and inexpensive electronic money, electronic wallets, payment points,…”

Or redundancy like:

“Dapp technology to provide global services to everyone around the world”

This “Hanchain Whitepaper” might seem technical, but it’s not specific. You can’t tell what makes it useful or different after three pages of reading. The “dual crypto platform” might mean something, but it’s not solving any unsolved problems.

With Bitcoin, Litecoin, and such, do you really need another platform to provide “crypto payments”? Another generic staking app? This isn’t 2018.

No “Proof Of Work”

In blockchain, proof-of-work is a network security model based on effort. The more computing power it takes to validate a blockchain transaction, the more trustworthy that validator user is. It’s used in Bitcoin, and the similar applies to whitepaper writing.

This is a lot of work:

This is not:

Which project seems to have more future, The Sandbox or this “2023 Token?”

(Hint: If your “whitepaper” is a nine-page slideshow, it probably doesn’t have much to offer)

Why does size matter? Because you can’t write long and specific unless you know what you’re doing. Most of the Top 20 tokens have whitepapers with around 10 pages of text walls.

And yes, there are exceptions like this excellent Lido Whitepaper:

Generally, low length equals low value.

No Computer Science

Whitepaper reading is hard. Even with a PhD in computer science, you won’t understand everything. And as a beginner, you should expect there to be all kinds of math formulas, coding functions, and flow charts.

Curiously enough, scam projects never do this. It’s very rare to find any technical reasoning. It’s always about the roadmap and benefits of buying the token.

Check this “Privacoin White Paper: ”

If you skim through any of the Top 50 coins, every white paper has some mathematical reasoning without exception. Pick a random scam project, and you’ll notice the opposite trend.

No Team

Decentralized or not, blockchains and dApps are made by people, and it helps to know something about that team. Ethereum, Tether, Aave, Liquid Loans, and even Bitcoin have some known members. When they’re not shown in whitepapers, they’re on the website, GitHub repositories, governance pages, or Youtube interviews.

Essential? No. But given two identical projects, it’s much safer to choose the one with the public team than the anonymous one that could rug pull anytime.

Token Distribution

Along with anonymous teams, token distribution can be a bright red flag. In a decentralized blockchain, the last thing you want is someone who controls most of the token supply. Because that may allow them to generate new tokens, create fake trading volume, or crash the coin when holders' confidence is high.

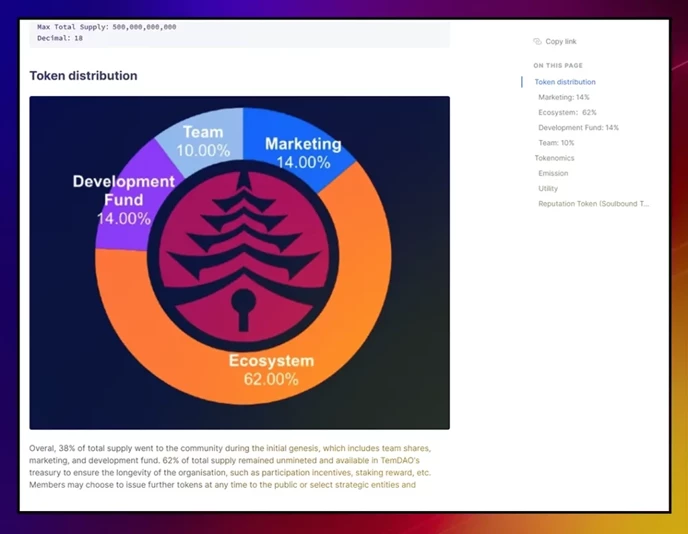

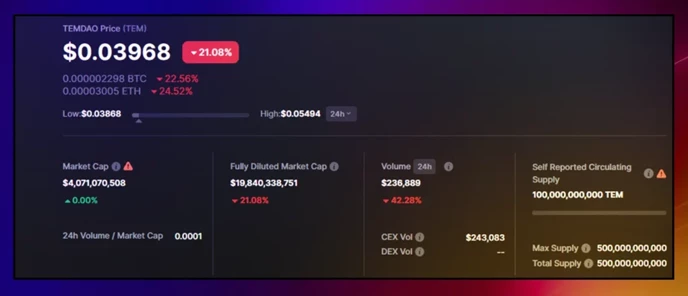

As a bad example, check the “TemDAO Whitepaper” tokenomics:

From the chart, you may assume that 62% of tokens are tradeable. But if you read the fine print:

- That 62% isn’t in circulation. How much of the 38% is it? The 14% of marketing?

- Members (and admins) can change the total supply. (“we can print as much money as we want!”)

- The self-reported supply is 100B out 500 (probably lower in reality). Why a DAO needs 500B tokens has little explanation. What’s worrying is the <20% circulating supply, which is well below the recommended 50%.

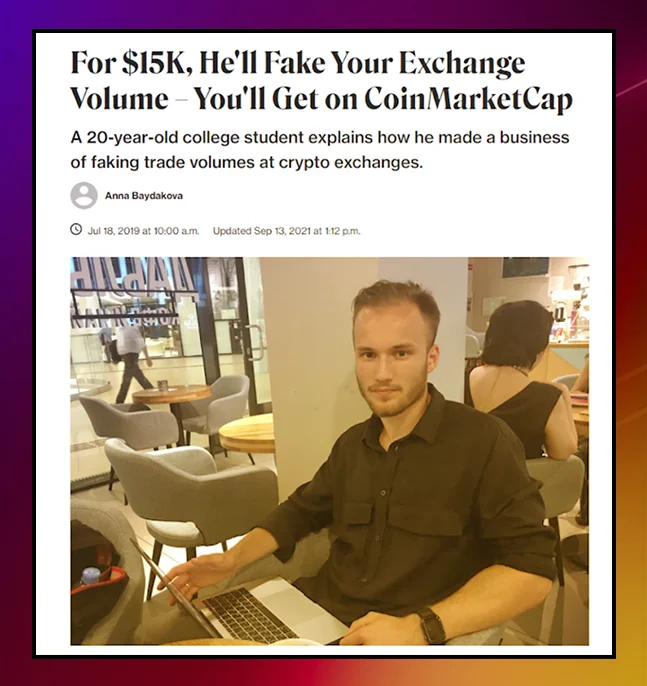

In these cases, only the whitepaper and the team identity can carry the project. The TemDAO paper is vague and anonymous. As for the trading volume, this article says it all.

3 Ways to Make White Papers Easy to Read

If you’re yet to read your first white paper, make sure you follow these three techniques:

Start From The End

Too many whitepapers start with an overview of the crypto landscape. This intro is followed by the project definition, technical break of every feature, market analysis, roadmap, economy, security comments, and eventually the summary. This structure fits developer audiences because they gather context to make their own conclusions and compare by the end.

But it always confuses the average reader.

Instead, start from the conclusion, abstract, executive summary, or litepaper (if any). If by the end you don’t know what the paper is about, it’s not going to help reading further. But if it makes sense, not only is the paper worth reading but becomes so much easier.

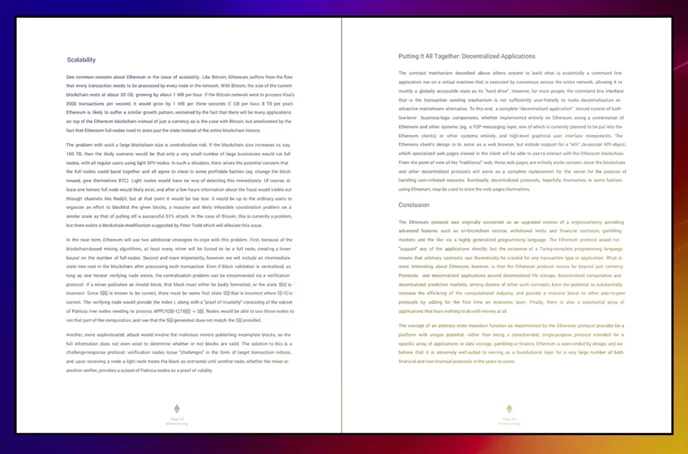

Suppose you know nothing about the Ethereum Whitepaper. If you only read a single page, which one would give you a better picture?

This?

Or This?

Use Great White Papers as Benchmarks

Whitepaper reading becomes easier over time because you already know what to expect. It’s also possible to recognize good papers within minutes, without having read hundreds before. It’s simple: once you’ve found a great whitepaper, you can use it as a template to contrast others that aren’t that clear.

In fact, that’s what we’ve done throughout most of this post.

Some good white papers are from Ethereum, BnB Chain, Avalanche, Fantom, and Uniswap. If you choose one of all those it’s not going to work, because projects are very different. Cryptocurrencies can represent blockchains, protocols, other currencies, governance features, or Metaverse economies.

That’s why we selected the three simplest white papers to compare with protocols, NFT platforms, and blockchains:

- Liquid Loans Whitepaper for DeFi Dapps:

- Enjin Coin Whitepaper for Metaverse and NFTs:

- Immutable X Whitepaper for blockchains:

Learn The Crypto Lingo

If this guide helped you make white paper reading easier, imagine how easy it would be if you also knew the crypto language. Luckily, that doesn’t have to take hours of learning. You can find the 70 most common buzzwords in our DeFi Dictionary.

Another resource to help you understand the whitepaper context is the overview of smart contracts and dApps.

FAQ

How Long Is a Whitepaper?

A crypto whitepaper is 2,500 words or 10 pages on average, about as long as a college essay. Depending on the token utility, it can be anywhere from 6 pages to 50. Length doesn’t always correlate with utility though.

The Bitcoin white paper has 9 pages, Ethereum 36, Lido Finance 6, The Sandbox 44, and Avalanche 66 across four files.

What if I Can’t Understand The Whitepaper’s Logic?

Guided whitepaper videos and crypto audits can help you understand the tech without knowing computer science.

If the project is popular enough, there might be many users on Youtube who will read and explain it line by line.

Crypto audits come from dev agencies who have reviewed the protocol’s code. This company shares the test results online, so you don’t need to know any programming to know if it’s safe. You can learn more about how crypto audits work here.

Is It a Good Idea to Invest in Crypto Ignoring White Papers?

You probably won’t lose your investment for not reading the whitepaper. If a cryptocurrency becomes as popular as, say, Ethereum, it has probably already proven its product-market fit.

If you’re a skilled short-term trader, the project fundamentals won’t matter as much. If you’re a long-term investor, you also want to check the audit to avoid losing it all on exploits.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Max

Max is a European based crypto specialist, marketer, and all-around writer. He brings an original and practical approach for timeless blockchain knowledge such as: in-depth guides on crypto 101, blockchain analysis, dApp reviews, and DeFi risk management. Max also wrote for news outlets, saas entrepreneurs, crypto exchanges, fintech B2B agencies, Metaverse game studios, trading coaches, and Web3 leaders like Enjin.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant