USDT Exposed: The End of Crypto’s Tether?

Whether you buy USDT or not, Tether can affect your entire crypto portfolio. Don’t let the market cap fool you. It’s not just another stablecoin, but quite literally the one that currently tethers all crypto together.

For many, it’s the go-to choice to hedge against the volatile markets. It’s been that way for nearly a decade, and despite its history, Tether has earned its title as the unbreakable buck. But if you think it’s too big to fail, think again.

Quick Takes:

- Tether (USDT) is a stablecoin that's supposedly backed by real dollars held in reserve. But the lack of transparency, murky history, and regulatory scrutiny have made it a lightning rod for criticism within the crypto community.

- As safer stablecoins start to emerge, the market dominance and future of Tether are uncertain.

- The rise of stablecoins can revolutionize the financial industry, but the concerns around Tether's legitimacy and reliability raise questions about the stability of the entire cryptocurrency market.

What Is Tether?

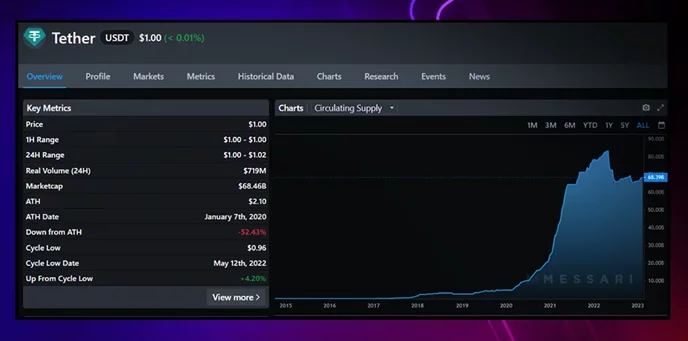

Tether USD (USDT) is a centralized and fiat-backed stablecoin issued by Tether Limited. Despite its questionable history, Tether has become the no.1 stablecoin for crypto market liquidity. The private company serves two functions: to control the USDT supply— now around ~$70B— and provide 1:1 conversions for real dollars.

Tether Limited claims to have the equivalent USDT amount in USD across its many bank accounts and investments. That’s why it’s called fiat-backed. If all exchanges suddenly disable withdrawals, you should still be able to redeem USD from Tether’s platform.

The same should be true for all fiat-backed stablecoins. But Tether is by far the most traded one, followed by Circle USD (USDC) with 1/10th of its $60B daily volume. It’s the primary means for investors to get in and out of crypto.

Despite its $70B market cap, a hypothetical Tether collapse would be enough to crash a $1T crypto market. That’s why investors should question how secure Tether really is.

Tether Stablecoin Explained

Stablecoins are tokens designed to mirror an asset’s price. There’s WBTC for Bitcoin, PAXG for gold, and Tether for US dollars. The 1:1 redemption of these assets is guaranteed by different backing methods:

- Fiat-backed stablecoins like USDT use real dollars as reserves.

- Crypto-backed stablecoins like Liquity USD (LUSD) use ETH for collateral and redemptions, so selling 1 LUSD equals 1 USD worth of ETH.

- Algorithmic stablecoins like USDL automatically adjust fees and token supply to maintain the 1 USD value.

A stablecoin isn’t a stablecoin without 1:1 trading, backing, and redeeming. As long as Tether has enough USD, you can always sell Tethers for a dollar. But these Tethers don’t run out, because the company can “print” more USDT as they receive real dollars from buyers.

This might remind you of old-fashioned banking. Customers would store gold with them in exchange for money, which allowed them to trade and get their gold back later. Replace banks with Tether Limited, gold with USD, and “money” with USDT, and you have the same system.

Except banks are better regulated. So what’s stopping Tether Limited from issuing more Tethers than dollars?

Tether and Regulation

Tether Limited might be the largest fintech company so far, and it sure has drawn regulatory attention. Their positions are mixed: it may all seem right on the surface, but the many red flags make Tether far from trustworthy. Some US states like New York are more critical, while others like Wyoming are more welcoming.

After all, Tether has maintained its 1:1 promise since 2014 (originally as “Realcoin”). Legally, it’s defined as a cryptocurrency issued by a private limited liability company (LLC) registered in the Virgin Islands (BVI). It operates as a “money service business,” subject to annual statements, background checks, and minimum net worth requirements.

As for 2023 regulations, this is Tether’s situation:

- Even though the Tether debate continues, the SEC leans toward the security definition because USDT isn’t sufficiently decentralized.

- According to the Bank Secrecy Act (BSA), US financial institutions like Tether Limited must set programs for anti-money laundering (AML) and know-your-customer (KYC). Otherwise, USDT holders cannot directly exchange USD on their platform.

- While Tether provides regular attestations, they’re insufficient for proving the dollar reserves. The full independent audit is still being delayed since 2017.

- While there are many regulatory bodies for cryptocurrencies’, Tether’s main three are the Security Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), and the Financial Crimes Enforcement Network (FinCEN).

- Tether services are prohibited in the state of New York since 2019 (more on this later).

Both US and non-US people can deposit, withdraw, and transfer with Tether. At least, indirectly.

How Tether Works

The role of Tether is simple in theory. You put one dollar in and get one dollar back. Except those dollars are kept in a blockchain format called USDT.

To make this possible, the Tether started small. Only a few million Tethers were launched for sale in 2014 to investors, the exact number being the U.S. dollars kept by the company. Most of it was in bank accounts, some of it in cash.

- If you want to buy USDT, you would send U.S. dollars through their platform, and once received, Tether would issue new Tethers sent to your crypto wallet.

- You can then send USDT to other addresses, exchange it for other cryptocurrencies, or bridge it to other networks.

- If you want to get back your USDT dollars, you’d send these tokens to Tether, and they make a bank transfer from their US accounts to yours. The returned Tether is then burned to keep the 1:1 ratio.

In the early days of Tether, anyone who met AML/KYC requirements could perform a crypto redemption from USDT to USD.. Restrictions appeared once U.S. regulators found out that Tether wasn’t transparent enough with dollar reserves.

Tether Limited didn’t like the regulatory pressure, so they desisted from doing business within the US in 2017. They can make exceptions for institutional investors with high net worth and experience (AKA ECPs, Eligible Contract Participants). Otherwise, Tether doesn’t directly allow US citizens, residents, entities, or non-US persons registered under those entities— as it’s the case of US crypto exchanges.

Do you think international clients have it easier? Think again:

- Right off the bat, Tether denies 1:1 trades. You pay the highest between a flat $1,000 or 0.1% (each for deposits and withdrawals). If you deposit $1M, you withdraw $998,001.

- The minimum fiat withdrawal/deposit is 100,000 USD

- There’s a required non-refundable $150 registration fee to prove you’re “serious” about an account. This can be deducted, provided you have $100k to trade. It only gives consideration— not the right— to approve your Tether account.

Unless you somehow meet all criteria, the easiest way is a centralized exchange (CEX). Instead of claiming Tether’s “reserves,” you use the exchange’s. Even US CEXs hold some USDT, and it’s easier to withdraw from these than from the Tether platform.

The Risks Of Tether

Before even discussing risks, some red flags have already appeared.

Tether doesn’t offer US dollars to US people except for very specific investors. They’re essentially a dollar provider that excludes the no.1 dollar country. It effectively protects them from regulation, mass withdrawals, and revealing their reserves.

It’s like creating a US bank where only non-US people can access its cash. Bank runs are unlikely to happen (also because of the $100,000 minimum). It’s just too convenient for fake reserves, and it’s too difficult for everyone else to prove otherwise.

Controversies aside, let’s first start with the fundamentals.

Systemic Risk

Tether is nothing short of prevalent. For years, its 24h trading volume has surpassed Bitcoin and the top 5 altcoins combined. It’s also three times higher than both USDC and BUSD. These three represent >90% of the stablecoin volume, which is about ~40% of all crypto.

Should anything happen to Tether, it would affect similar stablecoins, Bitcoin, and thousands of correlated tokens. It doesn’t matter whether you hold USDT or not.

As a metaphor, Tether for the markets is like dollar balances for CEXs. If USDT halved its supply, that’s like an exchange halving its withdrawal capacity. Except it affects all blockchains and platforms with USDT pairs.

This destabilizes the already-volatile crypto market.

Fiat Currency Risks

As a fiat-backed stablecoin, the risks are similar to traditional finance:

- Insolvency risk from issuing more than what’s held in reserves. Especially in bad markets, customers are more likely to find out.

- Without timely redemptions, fiat stablecoins risk depegging. Without the $1 guarantee, most holders would rush to sell in fear of a collapse— a self-fulfilling prophecy.

- Even if Tether were 100% trustworthy and backed, there’s still dollar devaluation. Long-term wise, commodities and blue-chip cryptocurrencies are better for preserving purchasing power.

Regulatory Risk

The point of blockchain is to offer an alternative system for finance and its use cases. Tether isn’t comparable to cryptocurrencies like Bitcoin or Ether, but it neither has the benefits of traditional banking. It’s not FDIC-insured, regulations are unclear, and transparency is lacking.

The NY OAG has rejected at least two Tether requests to hide reserves reports from the public.

Centralization Risk

Without regulatory oversight, Tether’s authority is very worrying to investors. At their sole discretion, Tether can:

- Change Terms or Service (e.g., fees and minimum requirements)

- Decline or ignore withdrawal orders

- Blacklist wallet addresses

- Choose the most convenient accounting firm, how much to share, and who can read those reports

- Mint billions of unbacked tokens to lend crypto, buy Bitcoin, or even fake trading volume.

There’s not enough transparency for regulators to limit the dangers of centralization. For example, Tether might mint Tether to buy Bitcoin to pump market prices, discourage USDT redemptions, or increase the value of digital assets held as reserves.

As we’ll also see later, a handful of companies hold over most Tethers ever issued. Which makes the token supply very volatile.

Insolvency Risk

Today’s Tether reserves are no longer traditionally backed with dollars, but instead, cash equivalents and different investments. A large one is commercial papers, which are unsecured loans to low-risk corporations. Crypto-backed loans are also common, but more volatile.

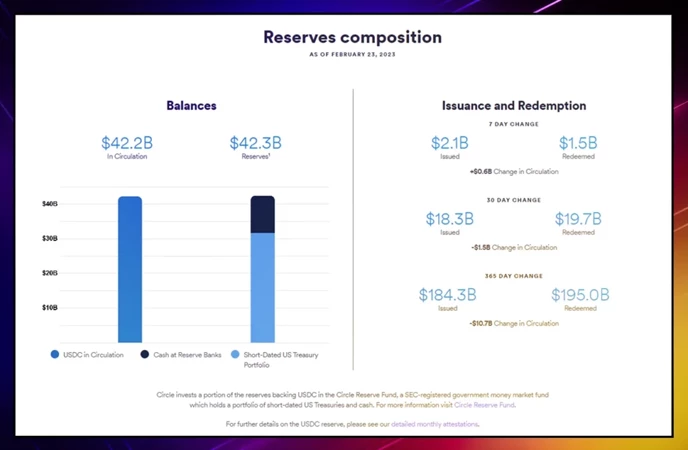

By contrast, USDC is backed only by cash and T-bills.

Tether’s composition is more complex. It neither discloses what “Other investments” mean, nor who it’s lending to (other than credit ratings).

Whether borrowers default on their loans or cryptocurrencies devalue, it’s unlikely that Tether is solvent at all times. Every time Tether reduces its supply, it’s either a USD redemption or an attempt to remove unbacked Tethers.

Tether's Controversial History

The story of Tether's rise to prominence is one that has left many in the crypto community scratching their heads. How could such an obscure organization withstand the test of time? This question gives away part of the answer.

Someone’s put great effort to make Tether as ambiguous and open-ended as possible. Here are the key events and controversies that have shaped Tether’s history, which will help to understand future ones.

The Rise as a Stablecoin Leader (2014 - 2017)

Like Bitcoin, Tether USD was the first of its kind. At least fiat-backed. The very first was NuBits and BitUSD (also launched in 2014). These are primitive algorithmic stables that were eclipsed by Tether.

The original Tether, Realcoin, was founded by Brock Pierce, Reeve Collins, and Craig Sellars. Only 500K Realcoins existed with almost no volume, but this would change in October 2014. A Hong Kong-based company acquired and rebranded it to Tether.

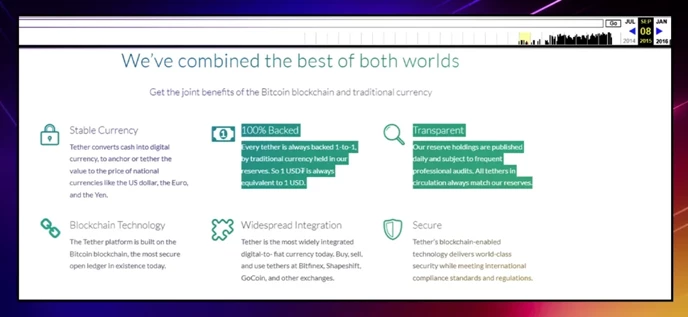

By early 2015, Realcoin investors claimed their tokens for the new USDT, now with over 2.5M tokens in circulation. The promise was clear and simple:

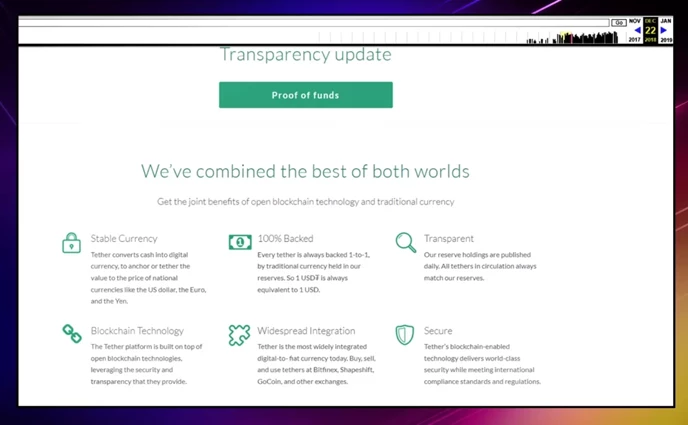

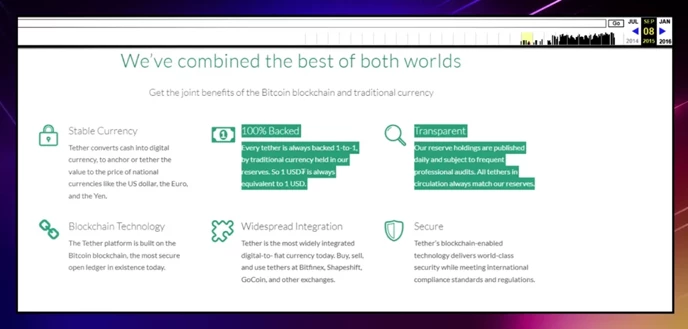

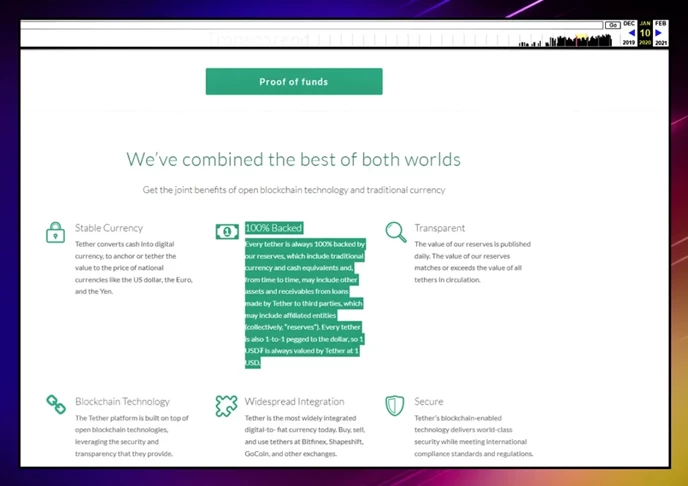

Every tether is always backed 1-to-1 by traditional currency held in our reserves. So 1 USDT is always equivalent to 1 USD.

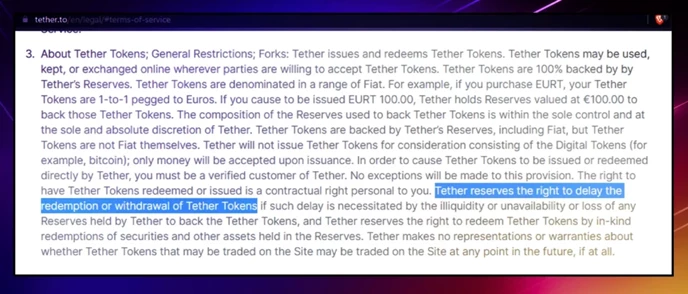

Everybody liked the deal until stablecoins started collapsing in late 2016. BitUSD and Nubit lost their pegs from that year, so it was reasonable to question whether Tether would be next. After a closer look at the Terms and Conditions (ToS), users found the following:

Tether reserves the right to delay the redemption or withdrawal of Tether tokens.

Tether (still) has no liability nor obligation to redeem anyone, making its reserves useless. In-kind redemptions mean that Tether doesn’t necessarily have to pay back in U.S. dollars. Tether would be protected at the risk of investors even if it collapsed.

But it didn’t, because it was backed by one of the biggest crypto companies of 2016. No one at the time knew of the 2014 acquisition, nor that the original founders had been replaced by an anonymous group. Until the Paradise Papers leak of 2017.

Bitfinex Ties Leaked (2017 - 2018)

A group of hackers infiltrated the servers of a Bermudian law firm. They accessed millions of files from offshore banks along with their company registries. They then provided these to a German newspaper, which turned them over to the ICIJ (International Consortium of Investigative Journalists).

The “Paradise Papers” included both Tether and the names behind its incorporation in BVI: Phil Potter and Giancarlo Devasini.

These names matched with leadership positions at Bitfinex, the largest exchange back then. The same was later found about Jean-Louis Van Der Velde, Paolo Ardoino, and Stuart Hoegner. Tether and Bitfinex are subsidiaries of Hong Kong-based iFinex.

And they’re all run by the same people.

Note that crypto regulation wasn’t as developed yet. Not only this would mean the shared liquidity of both platforms, but potential market manipulation. Imagine that hypothetically:

- Tether mints USDT at their discretion without having received U.S. dollars

- They send them to their Bitfinex exchange and buy Bitcoin

- Since they don’t need to redeem their own USDT, they burn it to rebalance the 1:1 ratio. Nothing to see here.

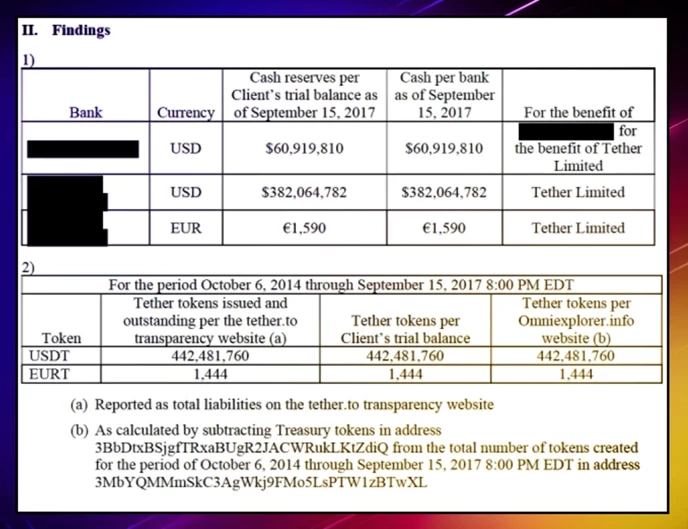

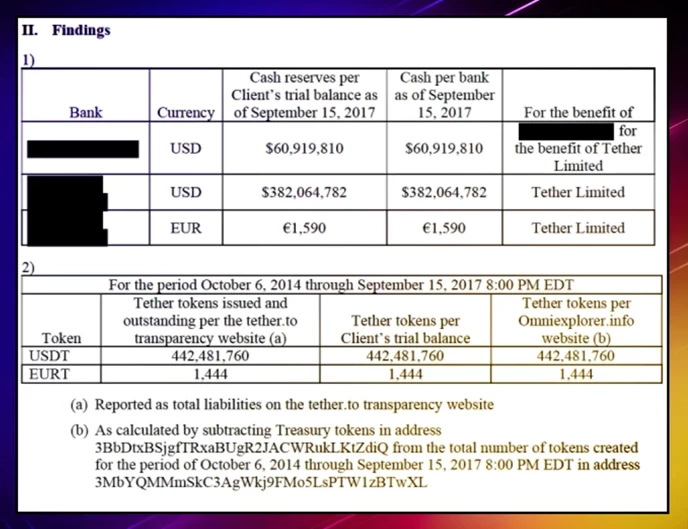

Now with credibility at risk, Tether attempts to regain it with a USD reserve attestation. They hired the accounting firm Friedman LLP to prove that their accounts hold as many U.S. dollars as USDT, now 440M. Friedman did find 440M USD but from an account snapshot made on September 15th at 8 PM.

After the Paradise Papers appeared in November, this “attestation” was no longer as reliable. So Friedman followed up with a formal, real audit. One that was so exhaustive according to Tether that they canceled it in January 2018. Now, there’s 1.5B USDT.

The OAG (Office of the Attorney General of the State of New York) started investigating Tether and Bitfinex in February 2018 and would later reveal the entire “operation.”

At this point, banks didn’t want to get involved with Bitfinex. It stopped working with Wells Fargo in 2017, next year with Noble Bank, and soon with Bank of Montreal (BMO). To continue the crypto-fiat business, it worked with a sketchier payment company.

One that not only dropped the ball but revealed their past misdeeds with Tether.

The OAG Steps In (2018 - 2021)

For Bitfinex, Crypto Capital would seem like just another payment company. Their options were limited, so the exchange started using this provider for their customer deposits. Thus $850M was in the custody of Crypto Capital, an unregulated Panamanian company with all kinds of risky clients.

By October 2018, Bitfinex lost those funds.

Co-founder Ivan Manuel Molina Lee was caught by Polish authorities with an international arrest warrant from the US. Ivan had been laundering money in Crypto Capital, which was linked to an international drug cartel. Whether all assets were seized or actually lost, Bitfinex was at risk of insolvency— and investigators suspected that they would cover up losses with Tether’s reserves.

And they did just that. But in the most complex way possible:

- Bitfinex secretly borrows ~$400M from Tether

- To reaffirm Tether’s reserves, they make another attestation with Deltec Bank. On November 1st, a public announcement confirmed the 1:1 backing with 1.8B USD.

- The next day, Tether (unbacked again) sends $475M to Bitfinex to finally offset the CryptoCapital loss.

- In April 2019, Bitfinex legally denied insolvency and got away without anyone finding out.

2 years later, the OAG did. Investigator Letitia James published this exhaustive report describing all of the above. Also:

- Tether didn’t have any bank accounts or verified backing before mid-2017.

- Tether planned the Friedman attestation to happen only when there were reserves. 8 PM on September 15th, 2017.

- Tether opened a Noble Bank account THE DAY BEFORE the attestation and received the $382M from Bitfinex.

- After several years without a single audit, Tether takes back the website Transparency claim.

OAG sued Bitfinex and Tether in April 2019 because they misrepresented reserves, and USDT was not backed 1:1 at all times. Both were fined $18.5M and are still banned from New York in 2023.

Despite the well-backed, unforgiving claims, the Tether General Counselor announced that there were “no negative findings” with the OAG report.

But to settle the investigation, Tether had to disclose the reserve composition.

Because by 2020, Tether was no longer backed by US dollars only:

The Reserve Composition Disclosure (2021)

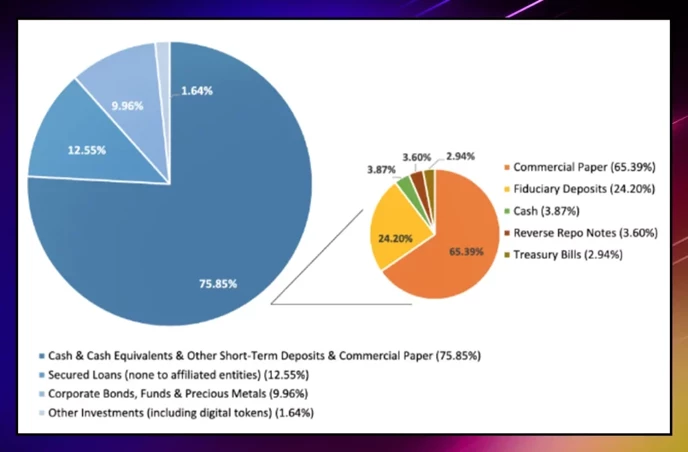

The long-awaited Tether revelations were… two pie charts in a blank document.

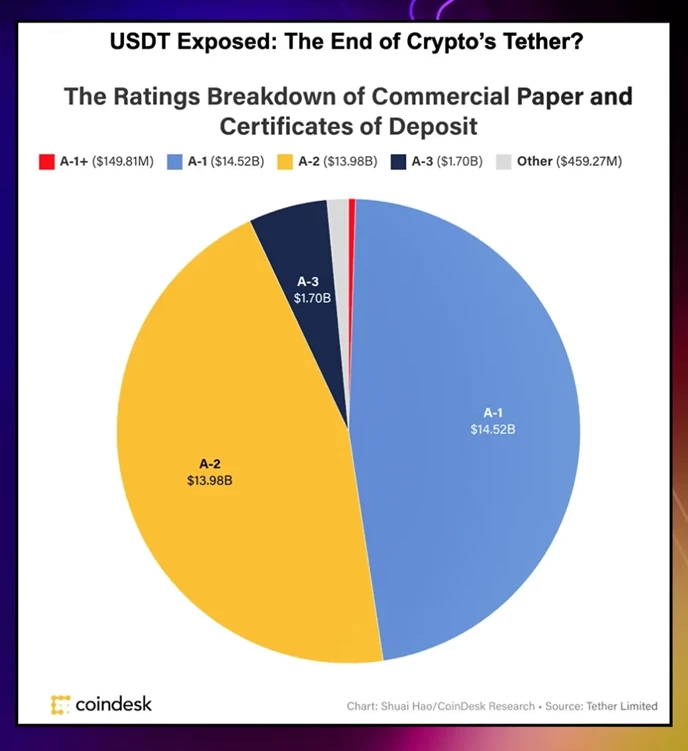

This is the reserve “composition” that Tether had to periodically provide for the OAG settlement. Not only is it not traditional U.S. dollars, but it’s been obfuscated not to alarm USDT users.

Some in the crypto community look at it like this:

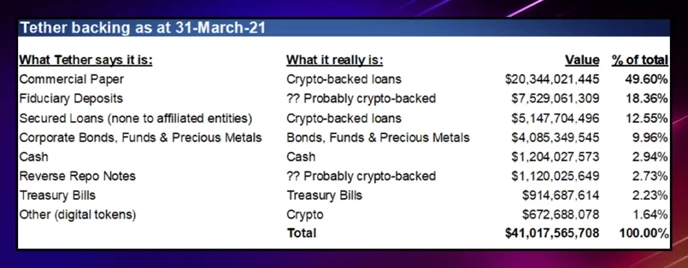

While this wasn’t enough for the investigation, there are some “assets” worth highlighting: commercial paper, secured loans, repo notes, and others.

Secured loans are the most straightforward. Tether lends USDT and/or borrows crypto with platforms like Bitfinex.

As for repo notes, a product manager (Martin Walker) says:

“It’s where you have lent cash in return for receiving collateral, usually bonds. I’ve never heard of a Reverse Repo Note before, and I am the product manager for a couple of repo trading systems and used to run repo technology at an investment bank.”

Commercial papers are unbacked short-term loans. Since all you have is a promise and credit rating, only large reputable corporations (e.g. Apple) should issue them. They’re possibly Chinese companies, but Tether never disclosed this.

Their goal is to reduce commercial paper holdings to zero— and they did reduce the $20B to $8.5B according to CTO Arduino… in 2022. Until then, 49% of Tether’s reserves were backed by nothing other than the promise of unknown corporations to repay.

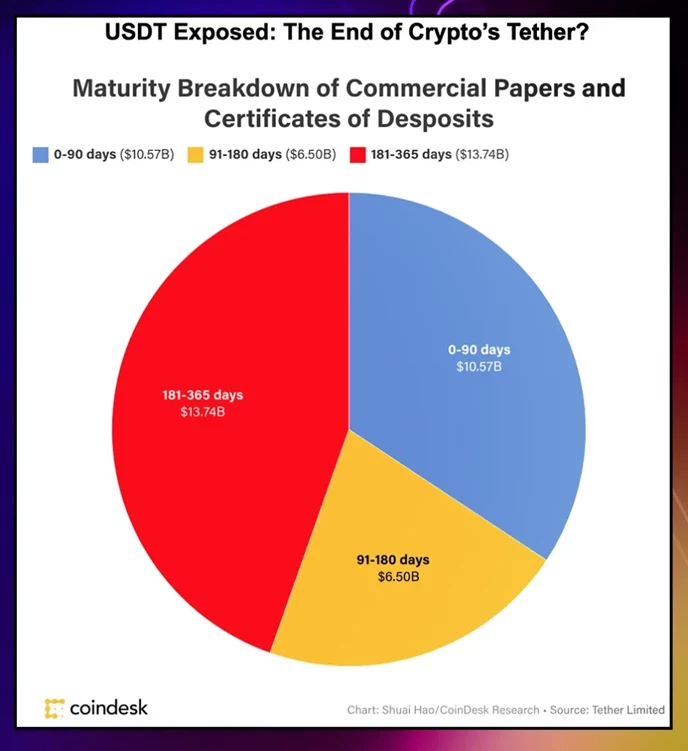

After this vague disclosure, Tether published a more detailed breakdown on June 30th:

According to Moore’s Report, Tether invested mostly in low-risk corporations (A2 and A1). And over half of the amount was redeemable in 180 days or less. By 2022, Tether would have replaced most commercial paper for US Treasury (T) Bills.

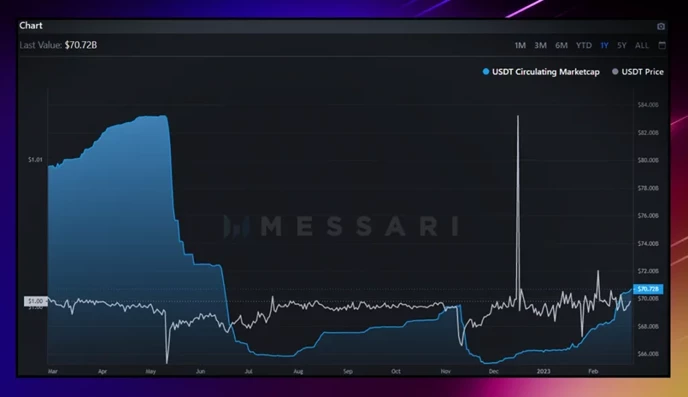

In February 2021, Tether signed the settlement agreement with the NY OAG. Once the investigation ended, now with safer reserves, Tether decided to sharply increase the USDT supply.

From 22B USDT to 64B in six months, and soon 83B. They would have kept going if it wasn’t because of the collapse of another $60B stablecoin. (in market cap)

Terra USD (UST).

The Aftermath Of LUNA (2022)

2022 wasn’t a good year for cryptocurrencies, and neither for stablecoins. Tether had to redeem ~10B USDT after the collapse of UST. This is an algorithmic stablecoin and was only backed by Terra Luna ($LUNA, now $LUNC). By then, it was the no.4 stablecoin and no.9 by market capitalization.

In May 2022, a billion-dollar sell-off moved UST from $1 to $0.91 during a market crash. LUNA’s market cap fell below UST’s so it was no longer 1:1 redeemable. Within a week, both tokens devalued by over 90%. Investors feared the crash of major stablecoins, so they started redeeming Tethers.

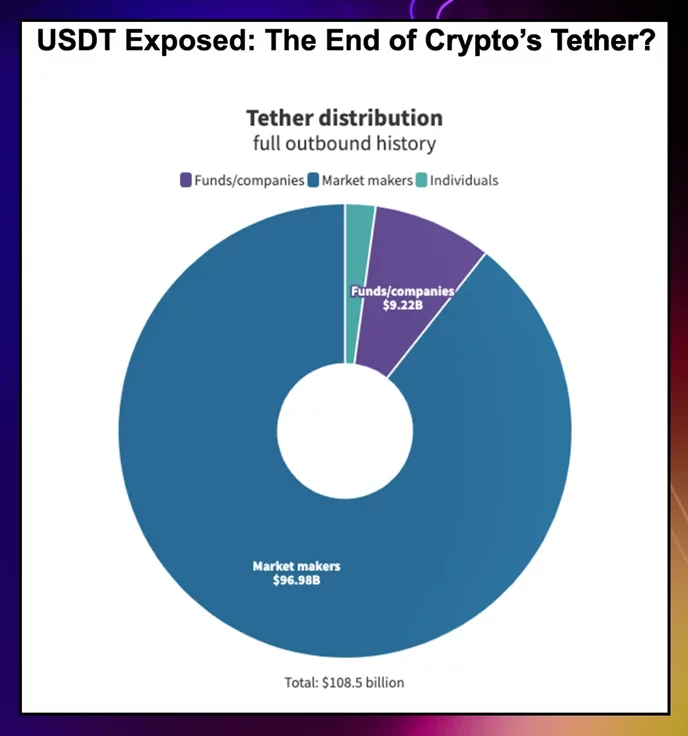

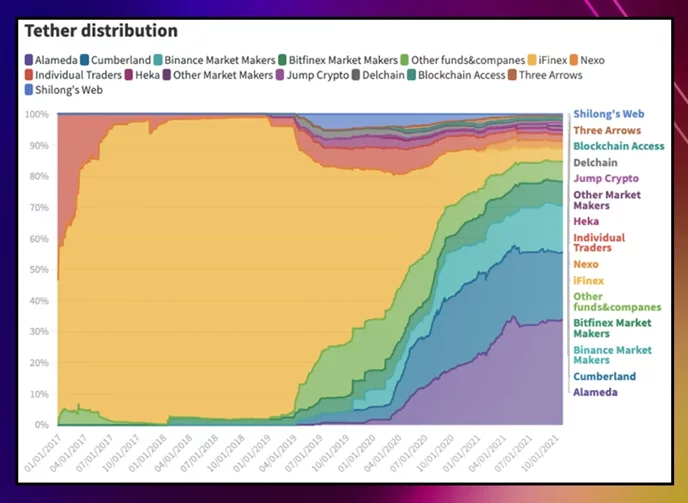

About 6 months earlier, Protos Media investigated who acquired most USDTs ever issued. Research reveals:

After the iFinex/Bitfinex incident, a few companies were responsible for 30% of the distribution, and as much as 80% before the collapse of FTX Exchange and Alameda in November 2022 (but that’s another story).

These companies probably redeemed Tethers right after LUNA’s crash in May, Celsius’ collapse in June, and FTX in November.

Unlike UST, USDT didn’t crash. But if only five companies control most Tethers, how easy is it to sharply reduce the supply? That’s less liquidity, more volatility, and a potential market crash.

And hypothetically, if these companies collude with Tether, how easy is it to hide true reserves from individuals — who own less than 5%?

Tether might be more reputable in 2023, but its future is uncertain.

Tether: A Ticking Bomb?

How is the most popular stablecoin also the most controversial one? But hey, if it ain't broke, don't fix it. Despite countless red flags, it’s the no.1 token for millions of users to hedge against crypto volatility.

What could possibly go wrong?

Whatever it is, regulators are taking measures to prevent it, both reactive and proactive. One of them is central bank digital currencies (CBDCs), a stablecoin alternative. Another is the regular request of reserve reports to make sure Tether remains 1:1 backed.

Along with USDC, USDT might be the most successful fiat-backed stablecoins yet. Not because of that it’s the best choice, and it wouldn’t surprise anyone if Tether’s convoluted history repeated.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Max

Max is a European based crypto specialist, marketer, and all-around writer. He brings an original and practical approach for timeless blockchain knowledge such as: in-depth guides on crypto 101, blockchain analysis, dApp reviews, and DeFi risk management. Max also wrote for news outlets, saas entrepreneurs, crypto exchanges, fintech B2B agencies, Metaverse game studios, trading coaches, and Web3 leaders like Enjin.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant